November 2010 Vol. 237 No. 11

Features

Western Energy Security: Will There Be A Gas OPEC?

Russia, the world’s top producer and exporter of natural gas, is spearheading Gas Exporting Countries Forum’s (GECF) efforts to inflate its profile and mission amid a global gas glut. Russia and fellow member countries Iran and Qatar form a troika that controls over half of global reserves. The troika is looking to extend trilateral cooperation and wants to ensure gas prices are vulnerably linked to those of oil.

Although there remains some debate concerning the potential influence that a troika-controlled gas OPEC could have on the world’s natural gas industry, gas cartelization certainly works against the West’s long-term energy security and its foundation of market-based principles. Here are some published views: 1) “Gas cartel could have a significant impact on Europe,” Times Online, 2008 , 2) “Natural gas troika could have impact on shale plays,” Fort Worth (TX) Business Press, 2009 , 3) “We are against cartelization. If a gas OPEC were created to control production or investment, it could create problems for the future functioning of the gas market,” Nobuo Tanaka, Executive Director of the International Energy Agency (IEA), 2009 and 4) “Gas Cartel Too Soon in the Making,” The Wall Street Journal, 2010.

——

Eleven Countries Hold 65% Of Proven Global Gas Reserves

The main purpose of the 11-member GECF has not been made overtly clear but the obvious conclusion is the formation of a natural gas cartel, modeled after the oil cartel OPEC, angled to manipulate global production and prices.

Like petroleum, the world’s conventional natural gas endowment is largely concentrated. According to data derived from BP’s Statistical Review of World Energy June 2010, a gas OPEC, based on the current 11 GECF member countries, would possess about 65% of total proven global reserves, or coincidently 11 times more than North America and the European Union (EU) have combined. Leonid Bokhanovsky, Vice President of Stroytransgaz, a highly connected Russian engineering-construction firm, was elected as the GECF’s first Secretary General in December 2009.

——-

The increasing importance of natural gas to modern societies raises new concerns regarding the security of global supplies and the potential creation of gas OPEC. Although natural gas is the favored “bridge” fuel to a low-carbon economy, and rising domestic reserves should offer natural gas an extensive role in climate change legislation, policy could have the U.S. shopping abroad prematurely. For example, the industry estimates that federal regulation of the formation fracturing fluids used in the development of shale gas – the key to incremental production – could cost up to $150,000 per well (all amounts in USD) and force 35% of our wells to close. And new taxes being proposed could overburden the smaller independents that produce more than 80% of America’s natural gas but typically have fewer than 20 employees. Importantly, the goal to replace existing coal-fired generation capacity with gas-fired capacity would increase annual U.S. natural gas consumption from 23 Tcf to 36 Tcf, according to a study released by the American Public Power Association in July 2010.

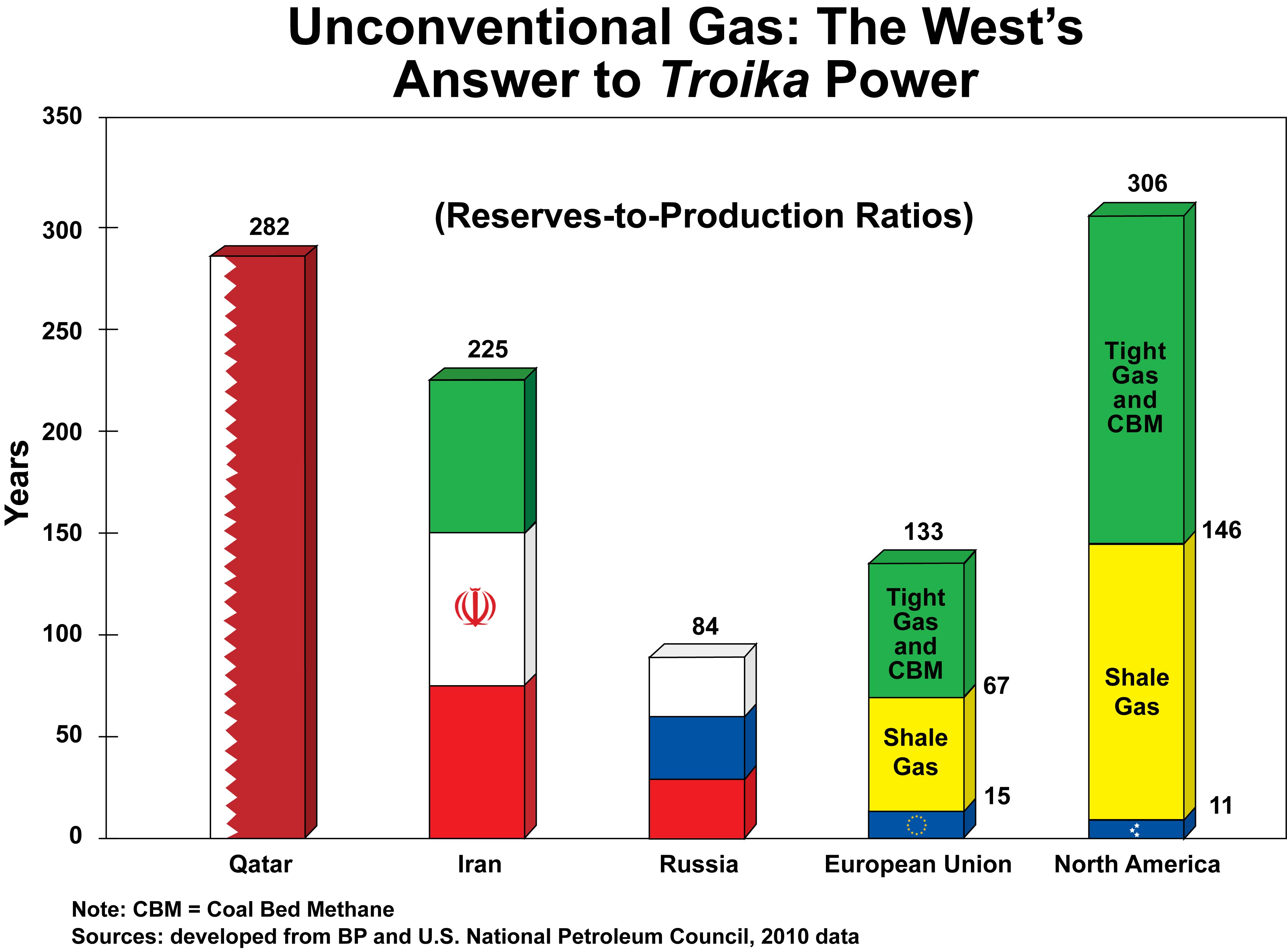

Policies that hamper our emerging unconventional gas stockpile in any way pose the real question: “Where will we get our new natural gas?” The U.S. Energy Information Administration (EIA) projects production from shale will surge fivefold from 2007 to 2035, “more than offsetting a decline in conventional natural gas production.” The EIA specifically credits shale as “the primary factor in increasing U.S. technically recoverable natural gas resources by almost 50% over the past decade.” Unconventional resources are the “game changer” that will allow the West to increase its reliance upon natural gas while avoiding the overwhelming reserves-to-production ratios that would otherwise be brought to bear by gas OPEC and a globalizing gas market (Figure 1). In this sense, the present analysis intends to bring a contribution to the discussion by profiling the natural gas export outlooks for Russia, Iran, and Qatar.

Russia

The variety of economical, geopolitical, and national issues that make the troika an undesirable energy partner are best exemplified by the case of Russia. The country has a stealthy propensity to utilize its massive resources to expand its sphere of influence. For example, the EU, which receives a quarter of its gas from Russia, was left short of supplies in January 2006 and 2009 due to pricing rows between Russia and Ukraine. The questionable business practices of Russia’s opaque gas monopoly, Gazprom, make it difficult to determine the country’s full rate of development. Flat year-on-year output reflects Russia’s aging fields and cumbersome state regulation. Production at the country’s three biggest fields (Yamburg, Urengoy and Medvezh’ye) is decidedly in terminal decline. Gas demand in Russia is second to the U.S, as the EIA notes Russia consumed more than 70% of the 24 Tcf of natural gas it yielded in 2009.

In addition to politically based investment decisions, Russia’s national energy policy to leave resources untapped until export markets and long-term contracts are in place indicates the future of the Yamal Peninsula, the key to incremental production, is rather precarious. The construction of its first LNG plant last year, however, signifies the hastening of Gazprom’s LNG master plan and the broadening horizons of Russia’s exporting supremacy. The plant is part of the $22 billion Sakhalin 2 development and will deliver fuel to Asia in tankers. When full capacity is reached later this year, the plant will ship 5% of the world’s LNG supply. Contracts have been signed as far away as the west coast of the U.S., where Gazprom is scheming a coup to capture a 10% share of the U.S. market within five to ten years.

Unfavorable U.S. market conditions, however, have upped Gazprom LNG cargoes to China, where the EIA projects natural gas consumption will nearly quadruple from 2007 to 2035. Russia has further plans to enter Brazil’s natural gas sector and is expanding activity in the Venezuelan upstream. Russia has shrewdly convinced the Europeans that all their energy security really requires are transit routes that bypass difficult Ukraine and create direct links with Gazprom’s fields. The projects in place are the Nord Stream pipeline, across the Baltic Sea to Germany, and the South Stream pipeline, across the Black Sea to Bulgaria. In the long term, the EIA believes Russia will indeed make the necessary upstream investments to continue supplying increasing volumes of natural gas to its neighbors.

Iran

Iran is the largest natural gas producer in the Middle East. In 2009, the EIA reports Iran produced 4.1 Tcf but consumed 4.2 Tcf with Turkmen imports accounting for the difference. Export projects have lagged behind troika allies but the two-thirds of Iran’s reserves that are undeveloped have China and India primed. Even with the planned expansion of the huge South Pars project, however, which is expected to increase the possibility of Iran supplying the EU via Turkey and the Nabucco pipeline, future export capacity will likely remain constrained. Domestic gas consumption has grown rapidly over the past 20 years and energy prices are heavily subsidized by the government. The 7% annual demand increase projected by the EIA over the next decade is doubtless conservative because Iran: 1) uses 30% of its natural gas production for re-injection into mature oilfields, 2) is extending national infrastructure to sell natural gas at reduced prices, 3) wants to shift to compressed natural gas vehicles to slash gasoline imports, 4) lacks the external funds for new investment in production, 5) has a strong opposition against natural gas exports, and 6) wants to enlarge its petrochemical sector.

Further, Iran’s menacing commitment to nuclear energy is hindering its ability to attract the international partners required for complete hydrocarbon development. The U.S. Department of State designates Iran as “the most active state sponsor of terrorism in the world.” The Iran Refined Petroleum Sanctions Act (H.R. 2194), signed into law by President Obama in July 2010, will be the most wide-ranging and harsh sanctions levied against the country thus far. The bill will give the Obama administration the authority to sanction companies that provide Iran with, or support domestic production of, gasoline and other refined products. This expansion of the already existing Iran Sanctions Act, which targets companies that invest more than $20 million in one year in Iran’s oil and gas sector, will cover a broad range of financial institutions and businesses and extend out to pipelines and tankers.

Iran’s energy exports already have a stigma associated with them because importers help fund the country’s Supreme Leader, Ayatollah Ali Khamenei, and his self-proclaimed battle against “Western enemies.” The Financial Action Task Force, a 34-member international fiscal watchdog group, recently advised investors and businesses dealing with Iran that their assets could be linked to “money laundering and financing of terrorism.” Clearly, political barriers are eroding foreign interest to invest in Iran’s energy industry and will persistently challenge the country’s production and export objectives. The goal to produce 8-9 Tcf by 2012, for instance, seems impractical.

Qatar

Cited as the troika’s most politically benign member, Qatar’s natural gas export outlook is of particular interest. The EIA reports Qatar consumed only about a quarter of the 2.7 Tcf it produced last year. As the largest LNG exporter in the world, 70% of the country’s exports are in the form of LNG. Development has mostly focused on large-scale projects linked to LNG or downstream industries that utilize natural gas as feedstock. These efforts tend to favor partnerships with international oil companies due to their advanced technologies and expertise. Qatar’s two majority state-owned LNG companies, Qatargas and Rasgas, are therefore working to develop and market its gas with, among others, Shell, Total, and ExxonMobil. Qatar plays a crucial role in the growing spot gas market and, along with other Middle Eastern countries, is the swing producer between the Asian and Atlantic markets.

The prospect of Qatar playing the counterweight to Gazprom’s control of EU supplies has prompted Russian efforts to pull Qatar into gas OPEC. For the EU, the assignment now is to ensure LNG cargoes keep coming rather than going east where prices have been higher. Qatar has generally sold its gas on long-term contracts but can redirect supplies if buyers pay up; it recently diverted gas to China that had been earmarked for the U.S. “We will not go to a low price market – there is a lot of demand for our gas elsewhere,” says Qatar energy advisor, Ibrahim al-Ibrahim. Qatar, and other shippers, have been deterred to send large amounts of LNG to the U.S. due to its increases in domestic supply, lowered demand and record-high inventories. Qatar wants to maintain its independent foreign policy but realizes it must also balance its relations with the U.S. and Iran.

Qatar’s wait-and-see approach will continually make its future export capacity inconclusive. Speculation is mounting that the North Field, the world’s largest gas play and the basis of Qatar’s production plans, may not hold as much natural gas as previously assumed. A moratorium was placed on additional projects at the field to examine strategies for development optimization. Continued economic growth could have Qatar preserving the bulk of its reserves for domestic development. Staggering energy sales have tiny Qatar being commonly referred to as “the richest country in the world.” Qatar has the second-highest gross domestic product per capita in the world (over U.S. $120,000), more than double that of the U.S. and those of the EU. Power generation, desalination and industrial growth will be given priority over the expansion of gas export capacity.

Conclusion

Despite a shaky future export capacity that will limit its leverage as the largest natural gas owners in the world, the troika seeks to compete against Western domestic resources over the mid- and long-term, namely our critical shale plays. Unfortunately, a globalizing gas market is destined to benefit a gas OPEC and the objective to challenge market-based democracies through high prices and wealth transfer. The Obama administration should thus take the lead in establishing a coherent global policy to mitigate gas cartelization predicated upon the reality that cartels thwart economic progress, exert price-fixing, and defy antitrust laws. In addition, North America and the EU must revamp efforts to expand domestic natural gas production by more fully opening their vast onshore and offshore resources to exploration.

The timely arrival of the U.S. shale plays is an industrial boon that illustrates how quickly modern technologies and increased opportunity can transform a country’s domestic energy outlook. The West should also more thoroughly engage heavily resourced Australia (a nation slowly slipping away to China) and those Gas Exporting Countries Forum members opposed to Russian-Iranian domination. The Organization for Economic Cooperation and Development (OECD) and the International Energy Agency must endure and work to amend the IEA’s constitution to possibly grant China, India and Brazil membership – over 80% of the world’s incremental growth in energy demand over the next 20 years will stem from non-OECD nations. Currently, these rising powers can only cooperate with the 28-member IEA through special partnerships.

Author

Jude Clemente is an energy security analyst and technical writer in the Homeland Security Department at San Diego State University. He holds a B.A. degree in political science from Penn State University and a master’s degree in homeland security from SDSU. He also holds certificates in infrastructure protection and emergency preparedness from the Federal Emergency Management Agency, the American Red Cross, and the U.S. Department of Homeland Security. His research specialization is energy security at the national and international levels. His most recent work has appeared in Pipeline & Gas Journal, Carbon Capture Journal, Journal of Energy Security, and Managing Power. He can be reached at judeclemente21@msn.com.

References

1. BP, June 2010, Statistical Review of World Energy June 2010. London, England, UK.

2. Carl Mortished, October 22, 2008, “Gas cartel could have a significant impact on Europe,” Times Online, via the website http://business.timesonline.co.uk/tol/business/columnists/article4988242.ece.

3. John-Laurent Tronche, January 19, 2009, “Natural gas troika could have impact on shale plays,” Fort Worth (TX) Business Press, via the website http://www.fwbusinesspress.com/display.php?id=9341.

4. Robert Tuttle and Ayesha Daya, December 9, 2009, “Gas Exporters Defend Oil-Price Link as Gut Grows,” Bloomberg News, via the website

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aJnUUF7seUEM.

5. Liam Denning, April 20, 2010, “Gas Cartel Too Soon in the Making,” The Wall Street Journal, via the website http://online.wsj.com/article/NA_WSJ_PUB:SB10001424052748703757504575194093781105262.html.

6. Tom Kenworthy, June 25, 2009, “Frack Attack: Drilling Technique Under Scrutiny,” Center for American Progress, via the website http://www.americanprogress.org/issues/2009/06/frack_attack.html.

7. Electric Light & Power, July 7, 2010, “APPA: Congress, EPA rules to impact coal fired generation,” via the website http://www.elp.com/index/display/article-display/6327220080/articles/electric-light-power/generation/emissions-environmental/2010/07/APPA__Congress__EPA_rules_to_impact_coal_fired_generation.html.

8. Energy Information Administration, July 2010, International Energy Outlook 2010. U.S.DOE: Washington, D.C.

9. Andrew Kramer,, February 19, 2009, “Russia, Looking Eastward, Opens a Gas Plant to Supply Asian Markets,” The New York Times, via the website http://www.nytimes.com/2009/02/19/business/worldbusiness/19ruble.html.

10. Council on Foreign Relations, August 2007, “State Sponsors: Iran,” via the website http://www.cfr.org/publication/9362/state_sponsors.html.

11. Nick Mathiason, February 18, 2010, “Iran tops new terror finance blacklist,” Guardian UK, via the website http://www.guardian.co.uk/business/2010/feb/18/iran-heads-terror-funding-blacklist.

12. Reuters, October 28, 2009, “Qatar diverts LNG to higher-paying China,” Trade Arabia, via the website http://www.tradearabia.com/news/ogn_169578.html.

13. Central Intelligence Agency, 2010, The World Factbook: Country Comparison GDP Per Capita, via the website https://www.cia.gov/.

Comments