April 2010 Vol. 237 No. 4

Features

From Drake To The Marcellus Shale Gas Play--Distribution Developments

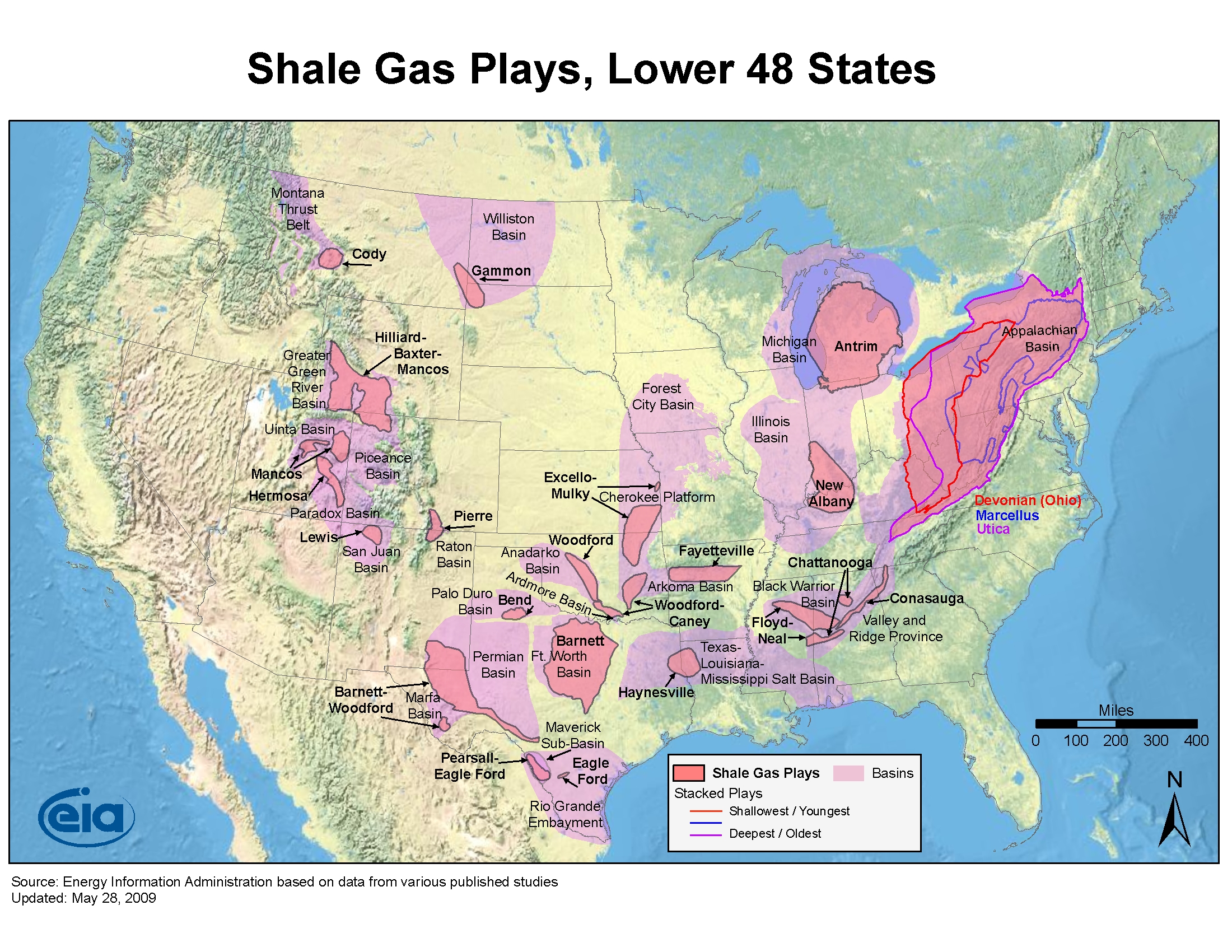

The North American shale gas revolution is entering a new phase of activity with gas production in the “Big 7” shale gas plays: Antrim, Barnett, Devonian, Fayetteville, Woodford, Haynesville and Marcellus, now estimated to be on track to rise to between 27-39 Bcf/d over the next decade – with the Marcellus now singularly recognized as the largest unconventional natural gas reserve in the world.

The very presence of shale gas in the domestic supply is fundamentally altering the supply equation and conventional wisdom seems to suggest that change flowing from this robust domestic supply will not just be a ripple on the water, but a paradigm shift, one that will reach well beyond North America. Modeling from the Baker Institute, a think tank on the campus of Rice University and founded by former Secretary of State James A. Baker III, indicates that future growth in shale gas production in North America will also have significant and long-lasting effects on LNG redirection and U.S. national security, trends which may lead to a lessening of both supply and leverage from countries such as Russia and Iran, in part through the strengthening of European consumer markets. In 2009, shale gas production helped the U.S. overtake Russia as the world’s largest producer of natural gas.

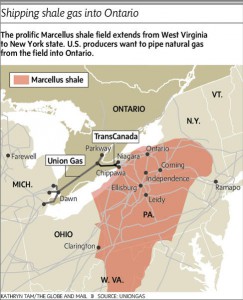

In Canada, major pipeline companies: TransCanada Corp. and Union Gas Ltd, a subsidiary of Spectra Energy Corp., have announced “open season” calls to gauge interest in reversing the flow of their existing export pipelines to import shale gas from the Marcellus into the Ontario market, thus offering shippers access options through Dawn. With the Western Canadian Sedimentary Basin having been in decline for some time, and coupled with the emergence of shale gas both in Canada and the U.S., Canadian pipeline companies are clearly thinking through their options. A recent announcement detailing Korea Gas Corp.’s C$1.1 billion investment in the development of EnCana’s shale gas acreage in British Columbia highlights that new Canadian supply options are not to be U.S. shale gas exports only.

On the world stage the shale gas effect has already taken leave of its North America base with major oil companies Royal Dutch Shell, BP and ExxonMobil moving headlong into the European shale gas revolution, buying up acreage and rights in France, Sweden, Hungary, Poland and Austria that potentially hold the keys to self-sufficiency. Witness ExxonMobil drilling a number of exploratory wells in Germany; Devon Energy teaming up with Total looking for approval to drill in France and a ConocoPhilips exploration initiative on a million acres in the Baltic Basin of Poland. Onshore rig deficits in Europe, likely environmental opposition as well as manpower and supplier shortages could hamper efforts, but those companies that have missed the onshore unconventional boat in North America might just catch this maiden launch overseas.

Wall Street’s interest in Marcellus has also seen a marked transition over the last few years from mere puppy love in 2007 to today’s levels of assurance and commitment – capped by the announcement of ExxonMobil’s $41 billion takeover offer for Marcellus independent oil and natural gas producer XTO Energy, a large acreage holder in the West Virginia – albeit confidence backed up with an escape clause in the agreement should Congress begin to tightly regulate hydraulic fracturing. That being said, with BP and ExxonMobil now moving into strong positions vis-à-vis North American shale gas, majors such as Chevron and Shell could very well look to establish stronger upstream onshore presences, chiefly through potential M&A’s activity on the horizon.

Several high-profile private equity deals announced in 2009 have further highlighted the confidence that investors have in this play. East Resources and KKR (Kohlberg Kravis Roberts), the private equity giant, reached an agreement with KKR paying $350 million for a minority stake in East. In addition, Chief Oil and Gas LLC and Enerplus Resources Fund announced a $406 million deal between the two with Enerplus acquiring a 30% stake of in Chief. Ernst and Young’s Jon McCarter estimates that over the next 12-24 months the pool of capital available for investment in the Marcellus could be valued at “north of $50 billion,” possibly even reaching the $100 billion mark.

Marcellus states with stakes in the play have each had markedly different responses to the opportunity. Companies interested in developing horizontal wells in New York state have found themselves waiting on the sidelines or moving projects across the borders into Pennsylvania or West Virginia. With the majority of E&P and midstream activities now focused in Pennsylvania and West Virginia, the industry is looking for the final word from the NYS DEP after nearing the end of a two-year process developing a draft Supplemental Generic Environmental Impact Statement (SGEIS); representing a set of key regulatory guidelines aimed at addressing Marcellus exploration and horizontal shale gas wells specifically.

In Pennsylvania, the home of much of the current activity, one group that has been gathering momentum as a leading voice for the industry there is the Marcellus Shale Coalition, a largely E&P-based industry group helmed by President and Executive Director Kathryn Klaber. With membership rising beyond the E&P ranks and with a strategy heavy on engagement, the Coalition seems to have found an effective approach to getting results.

”Speaking with a unified voice; articulating a set of solutions that will benefit all concerned and engendering a culture of best practices in matters that impact our economy, our environment and our communities is job one for me,” stated Klaber. With a distinctly inclusive style, Klaber, who has a background in bringing sometimes disparate groups together, may be the ideal spokesperson and bridge for an industry looking to hold on to what has worked so far while simultaneously enlarging their space to include government, community leaders, higher education and many adjacent industries that are benefiting from the economic expansion associated with this opportunity.

Klaber, when she speaks to groups around the state, often reminds listeners that on the E&P side it takes, “50-75 different businesses engaged together in the development of one well; this represents a new face on the opportunity – jobs – a great deal of local jobs.” Public perception, industry groups, state and national politics, taxation and regulatory action will all play significant and, at times, competing roles in this process as the Marcellus continues to heat up and infrastructure buildouts expand.

Distribution

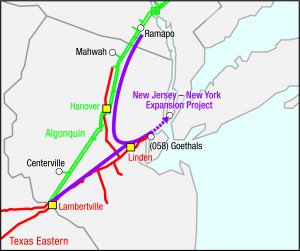

The potential of this massive and local Marcellus gas supply is altering the outlook and strategy of many of the major LDCs in the Northeast. Recently, several announcements have brought the point home, turning speculation toward harder facts with Spectra’s agreements with Chesapeake Energy, Statoil ASA and Consolidated Edison to bring Marcellus gas to market, as well as Millennium Pipeline’s open season announcement for transportation of Marcellus gas bound for New York and New Jersey.

At the close of 2009, Spectra Energy Corp. signed binding precedent agreements with Chesapeake Energy Corporation, Statoil Natural Gas and LDC Consolidated Edison for an expansion of its existing Texas Eastern Transmission and Algonquin Gas Transmission, with capabilities to transport up to 800 MMcf/d of new Marcellus gas, targeted to be in service in 2013. Consolidated Edison will connect through a 16-mile extension to Texas Eastern’s pipeline through a new interconnect to be located in New York City that is planned to enhance service reliability in the New York metropolitan area while increasing consumer access to diverse and abundant supplies. Consolidated Edison, a 180-year-old LDC, serves 1.1 million customers in New York metropolitan area and Westchester County through Consolidated Edison Company of New York and provides gas service to more than 126,000 customers in southeastern New York and adjacent areas of eastern Pennsylvania through Orange & Rockland Utilities.

Millennium Pipeline, a New York state-based interstate pipeline, which services the Northeast and is anchored by National Grid, Consolidated Edison, Central Hudson Gas and Columbia Gas Transmission announced in January a binding open season for shippers seeking firm transportation capacity commencing in 2013. Millennium is jointly owned by affiliates of NiSource Inc., National Grid and DTE

Energy – three companies with major LDC systems in the Northeast.

NiSource Inc. delivers gas to customers stretching from the Gulf Coast through the Midwest to New England through Bay State Gas Company, Columbia Gas of Ohio, Columbia Gas of Maryland, Columbia Gas of Kentucky, Columbia Gas of Pennsylvania and Columbia Gas of Virginia. National Grid is the largest distributor of natural gas in the Northeast, serving 3.4 million customers in Massachusetts, New Hampshire, New York and Rhode Island; DTE Energy is a Detroit-based diversified energy company which operates MichCon, a natural gas utility serving 1.3 million customers in Michigan.

National Grid, like many major LDCs in the Northeast, sees both opportunities and challenges in the Marcellus Effect. James B. Howe, Sr., Vice President Network Strategy for National Grid, with responsibility over all U.S. gas distribution, said “there are major changes occurring in conceptions of natural gas migrating from bridge fuel to being part of a long-range viable, clean-energy solution. Fundamentally, Marcellus is about enhanced reliability for us; a diversity of supply options, new paths and greater flexibility to deal with matters on an hourly and daily basis.”

National Grid, along with the other major utilities in the NY/NJ area, are seeing usage trends continuing to grow and, given that “Marcellus represents a clean, local and potentially endless supply of Natural Gas, this is going to be great for our customers. In our minds, a large supply source potentially has the ability to reduce volatility and reduce prices long term. This is the basic supply and demand rule. We have seen that effect over the last 12 months and it continues to benefits our customers and the communities that we serve,” Howe said.

Regarding Millennium Pipeline, Howe said “this is an asset that is sitting right in the middle of the Marcellus shale gas play; it represents another viable path as time goes on. The pipeline is nicely positioned and will become a great piece in bringing gas to the NYC metropolitan area and, for that matter, the way the system works could bring on to NE.”

With National Grid holding significant unencumbered capacity on most of the major pipelines in the region and local shale gas supplies fitting stated diversification goals as well as asset-optimization opportunities, the challenges appear to be in the execution of the broad infrastructure programs that pipeline companies are now unveiling.

Suppliers To Marcellus

Companies active in the Marcellus are developing their own playbooks on how to manage winning strategies aimed at successful infrastructure buildouts. Whether the intent is to complete Marcellus wells, gathering systems or pipelines; approaches vary depending on specifics. What most are conceding is that there must be a strong regional vendor base of support to bring activities to fruition with lessons learned during the course of infrastructure development, often in other North American shale plays, exercised in concert with a cadre of regional vendors who understand the local challenges and have the world-class assets and technical sophistication required to succeed.

As the North American gas supply map continues to evolve in response to the abundance of new shale gas production, a shift in direction among the natural gas industry’s products and services supplier base can be clearly felt across the Marcellus shale region. Fundamental changes in the market are leading suppliers in a new direction in the Northeast – a new orientation from a predominately manufacturing and local production outlook to what is emerging as a reconstituted solutions-based consumer market with shale gas underfoot and new pipeline projects weaving across familiar fields

One such supplier, Dura Bond Industries, a third-generation privately owned large-diameter pipe manufacturer, pipe coating and steel fabrication company, located directly inside the Marcellus fairway, with 450 employees and in excess of $200 million in sales, has found itself riding high on a new jet stream of energized Marcellus opportunities. From the rough-and-tumble world of coal tar pipeline coaters that arose in Pennsylvania after WWII, Jim “Buster” Norris founded Dura Bond in 1960, operating as a local hand-coating company working on specialized pipe.

The purchase of McKeesport Coating Co. in McKeesport, PA in 1982 offered Dura Bond the ability to coat line pipe with coal tar enamel in high volumes, putting them on the map as a high-volume coater. A new fusion bond plant in McKeesport a decade later doubled production capacity. In 1993, DB bought the fusion bond coating line in Steelton, PA where they coated large-diameter DSAW pipe for Bethlehem Steel. By 2003, Dura-Bond purchased the entire 600,000-square-foot pipe-manufacturing plant and founded Dura-Bond Pipe, LLC and today manufactures word-class straight seam expanded API line pipe. The acquisition of the Steelton facility required new management, new approaches and a streamlining of the manufacturing processes.

“As the only American-owned straight seam mill in the U.S. and with our facilities in the Marcellus we are seeing the power of this infrastructure buildup first hand. With our pipe manufacturing and coating assets in general and our McKeesport plant centrally located in the fairway, customers can ship in pipe from any mill and have us coat and store or we can manufacture pipe and store for stringing to the right-of-way. Logistics have become the big question and can be challenging; our customers tell us they find the easiest thing is to deal with a local coater,” said Jason Norris, vice president – Commercial of Dura Bond explaining the “Marcellus Effect” on the ground in Pennsylvania.

Dura Bond, in response to these massive Marcellus-related requests, is in the midst of expanding the McKeesport facility with the addition of a new fusion bond coating facility located on additional land that will more than double their current capacity to coat and store pipe.

“Houston-based energy companies have a strong awareness of us from our reputation, but once you start believing that everyone knows you is when you lose sight of the customer. We intend to remain the dominant player for pipe manufacturing and coating in the Marcellus. For 50 years we have been successful with our customers by being agile and customer-oriented and for as long as we are here, that will never change.” Norris said.

Faced with insufficient numbers of key personnel to hire based on projected activity levels, industry is grappling with the right combination of local and out-of-state vendors, contractors, maintenance support, technical support, compression companies, mechanical engineers, to name a few. The solution has been to educate the regional pool, import shale teams from the Southwest or find existing regional heavyweights that can assist.

Dresser

Dresser Inc. has a long history and wide national footprint, charting over 129 years of technology innovation in the natural gas industry from its roots and foundational home in Bradford, McKean County, PA to its present day scale as a multibillion-dollar company.

An approved station fabricator to all major gas transmission pipeline companies and one of the largest turnkey solutions providers located directly inside the Marcellus regional hub, FloSystems solutions are designed and manufactured out of Dresser’s 340,000-square-foot, state-of-the-art facility in Bradford with a focus on an array of measurement and regulation solutions to producers, transmission companies, midstreamers and utilities.

Dresser also supplies Mooney and RedQ pressure regulators and Becker flow control valves to the natural gas industry. All are known and proven throughout the distribution, transmission and midstream segments of the industry for unparalleled performance, positive shut off, ease of maintenance, low minimum operating differential, reliability and versatility. Coupled with no bleed pilots and control instrumentation, the result is a highly accurate pressure or flow control device that maximizes operations and uptime.

Author

Derek Weber is Business Development Manager – Marcellus Activity, Infrastructure Solutions, Dresser Inc. He can be reached at 518-951-6336 or derek.weber@dresser.com.

Bibliography

Airhart, Marc, “The Barnett Shale Gas Boom – Igniting a Hunt for Unconventional Natural Gas Resources”.

Barlas, Stephen, “TGPC Could Be First To Carry Marcellus Shale Gas”, 2010 Budget News.

Considine, Timothy; Watson, Robert; Entler, Rebecca; Sparks, Jeffrey, “An Emerging Giant: Prospects and Economic Impacts of Developing the Marcellus Shale Natural Gas Play”, The Pennsylvania State University College of Earth and Mineral Sciences, Department of Energy and Mineral Engineering, Aug. 5 2009.

Driver, Anna, “U.S. energy companies bullish on Marcellus shale”.

Hoyos, Carola, “Europe The New Frontier in Shale Gas Rush”, The Financial Times, March 8 2010.

Kell, John, “Spectra Reaches Pact to Expand Two Projects”, WSJ Dec 29 2009.

King, Byron W., “Rocks, rock oil and peak oil”

Payne, Darwin, Initiatives in Energy: The Story of Dresser Industries 1880-1978, Simon & Shuster, New York, 1979.

Tronche, John-Laurent, “Marcellus Shale – Appalachian Basin Natural Gas Play”.

Comments