June 2009 Vol. 236 No. 6

Features

Pipeline Opportunities Conference Draws Record Crowd

The fifth annual Pipeline Opportunities Conference, sponsored by Pipeline & Gas Journal and the Interstate Natural Gas Association of America (INGAA), was held March 11 in Houston. The single-day conference drew a record 519 attendees who came to hear 15 top industry executives discuss new and ongoing pipeline projects, technological advancements to help natural gas and product pipeline operators, and a member of Alaskan Gov. Sarah Palin’s pipeline team presented an overview about the long-planned Alaska Natural Gas Pipeline Project.

Other topics covered at the event included presentations by Scott Thetford of Pace and Ken Medlock of the Baker Institute for Public Policy who discussed the growth and challenges of the North American and international natural gas markets. Panelists representing transporters provided a lively and informative perspective on the challenges of transporting massive equipment plus the many miles of pipe sent to construction sites.

Doug Foshee, president and CEO of El Paso Corp., gave an upbeat keynote address during lunch on his company’s plans. El Paso owns North America’s largest interstate natural gas pipeline system and is one of North America’s largest independent natural gas producers.

Jeff Share, conference organizer, said it was reassuring to see such high attendance despite the weakened economy.

“Everyone is concerned about the state of the industry, especially after a prolonged boom period that many thought would never end. We can’t make any predictions but at least we could offer the speakers who have the best information available,” said Share, editor of Pipeline & Gas Journal.

In the opening address, INGAA President Don Santa, a Washington insider and a former member of the Federal Energy Regulatory Commission, cautioned that it is too early to get a handle on the new administration and that many pieces still have to fall into place in order to anticipate what any new changes will mean for the natural gas pipeline industry.

He did, however, provide the following preliminary observations:

- Oil and gas prices are down but there is still intense interest in addressing energy policy in Washington;

- Congress is likely to adopt a national renewable energy standard, which could be both good and bad news for the gas industry;

- Key congressional leadership changes to committees that have energy oversight responsibilities and new faces at the FERC could have far reaching implications for the gas industry;

- The Obama administration’s proposal to repeal the deduction for intangible drilling and development cost tax incentives is causing alarm in the industry;

- Natural gas is affected by what is going on in Congress even if gas is not the focal point of the energy or environmental legislation that is being considered; and

- The administration’s climate change policy is going to be a game changer for U.S. energy policy and it will impact natural gas markets and the various sectors of the natural gas industry.

“Clearly, policy makers are not thinking about the harm they can cause the gas supply and industry if they are not careful,” Santa warned.

Santa also noted that while the Obama administration had expressed support to build a pipeline from Alaska’s North Slope to the Lower 48, so far, no significant steps have been taken.

In the New Technologies for Pipeline segment that followed, panelists representing the Pipeline Research Council International (PRCI) discussed ongoing new technologies designed to help natural gas and oil products pipeline operators.

In the session Moving Energy Products, Mike Howard, president of Energy Transfer Partners, provided attendees with an overview of recently completed pipeline projects and projects under way. He used the accompanying slide to show that during 2008, Energy Transfer completed more than 440 miles of large diameter pipeline projects and more than 310 miles in 2009.

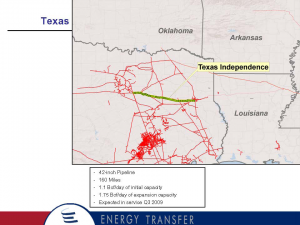

Turning to construction activity in 2009 to 2011, Howard noted that construction of the 160-mile Texas Independence Pipeline, expected to begin service in the third quarter of 2009, will connect the Partnership’s existing central and north Texas infrastructure to its East Texas pipeline network. With the addition of compression, the project may be expanded to transport natural gas volumes in excess of 1.75 Bcf/d.

Energy Transfer is also scheduled to build the 185-mile Fayetteville Express Pipeline that will originate in Conway County, AR, continue eastward through White County, AR and terminate at an interconnect with Trunkline Gas in Panola County, MS. The pipeline will have an initial capacity of 2 Bcf/d and is expected to be in service by 2010.

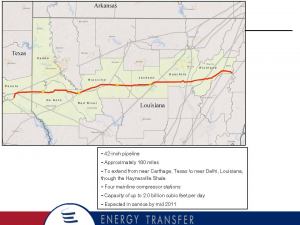

Another project discussed was the Tiger Pipeline to provide takeaway capacity from the East Texas Carthage Hub area and the Haynesville Shale play. The project offers potential delivery to seven interstate pipelines for delivery to Midwest and Northeast markets. The 180-mile, 42-inch diameter pipeline will have an initial capacity of 2 Bcf/d and is due to begin service in the second quarter of 2011.

In his discussion of the 500-mile Midcontinent Express Pipeline, Howard noted that construction was winding down on the project that is a 50-50 joint venture between Energy Transfer Partners and Kinder Morgan Energy Partners. A short time later, on April 24, the Midcontinent Express Pipeline began interim service on 266 miles of 42-inch pipeline from the interconnects with Houston Pipe Line Company and Natural Gas Pipeline Company of America (NGPL) located near Paris, TX, in Lamar County, to an interconnect with the Columbia Gulf Pipeline near Delhi, LA. The capacity available to Columbia Gulf Pipeline is 641,000 Dth/d. MEP will also have primary firm deliveries available to NGPL in Atlanta, TX. Deliveries to Texas Gas and ANR Pipeline near Perryville, LA, began around May 1, and receipts from Enogex Bennington Bryan and deliveries to CenterPoint Energy Gas Transmission near Delhi a few weeks later.

Also in this session, NiSource Gas Transportation & Storage General Manager Colin Harper provided an overview of activity on the company’s Columbia Gulf and Columbia Gas Transmission pipeline system.

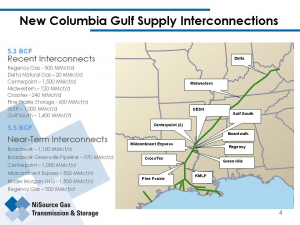

In overviewing activity of the past several years, Harper shared the accompanying slide that shows the 5.3 Bcf/d of gas supply capability added to its Columbia Gulf system. Moreover, he indicated six interconnects are planned in the near future that will add another 5.5 Bcf/d of new gas supplies.

Depending on activity in the Barnett, Fayetteville and Haynesville Shale, Harper said they might have as much as 15 Bcf/d of new deliverability coming into its system in the next five to six years. “Certainly the economic conditions we’re going through right now, the downturn and the rig count dropping could have an impact. But I believe it is only an impact of time, not the bottom.”

Harper noted that for the past two to three years the focus on the Columbia Gas (or Peco) system has mainly on been on developing and growing working storage capacity. “We currently have 37 gas storage fields on that system with a working gas capacity of 252 to 255 Bcf and are in the process of expanding three of those fields.

“Recently our focus has been on addressing the needs of Marcellus Shale,” he said. “I’m sure you’ve heard a lot about it and you will be hearing a lot more. This could be one of the largest gas plays in North American history.”

Harper also discussed the challenges associated with shale production.

Noting that millions of acres have been acquired to bring on new gas production, he cautioned that the two major challenges shale producers face are gas quality and water.

“From a gas quality standpoint, especially at the southern end, operators have encountered high ethanol concentrations,” he said. “What you see in a normal pipeline stream is 2 to 7 percent ethanol. What we’re seeing right now from the test wells is 12 to 17 percent ethanol, which will have to be stripped out. We have been involved in a joint venture with Mark West on a couple of fields so far. I’m sure we will be sitting down with some of the other players as well to address the gathering and processing needs of this particular area.

“The Btu content of this gas is also upward of 1130, and what we need in our pipeline stream is about 1030 to 1035. So you can see this is very hot gas.”

The Marcellus also has a very high concentration of water. Because states don’t always have limits on water withdrawls, this is of growing concern. For example, both Pennsylvania and New York are starting to clamp down on the producers and require special permitting before any drilling can take place,” he explained.

Harper also indicated that some of his excitement about the Marcellus Shale area had to a lot to do with the fact that the Columbia system has a huge footprint over the Marcellus Shale area. “Our footprint, from a gathering to major transmission, covers a significant part of the Marcellus Shale,” he said.

Harper was also quick to point out that at this time they did not have either the producer push or the market pull to justify building a major, significant big-inch pipe across the region. “So, what we’re doing right now is expanding our system, phase by phase, adding to certain projects,” he said.

In addition, he provided details on five active projects — Line 1711, Line 1570, Line 1360 and the KA and Cobb expansions, which will add some 650 Bcf/d of new incremental gas supply into the company’s system.

He said, “What these smaller projects lead up to is really the bigger picture. What we want to do is not only lay an express line along our existing right-of-way pipeline corridor but also add express lines to take this production out of these areas all the way to New York and New Jersey.”

Other highlights of the session included presentations by Jim Lelio, Director of Business Development, Kinder Morgan Renewable Fuels and Denise Hamsher, Director Public, Federal & State Regulatory Affairs, Enbridge Energy Company.

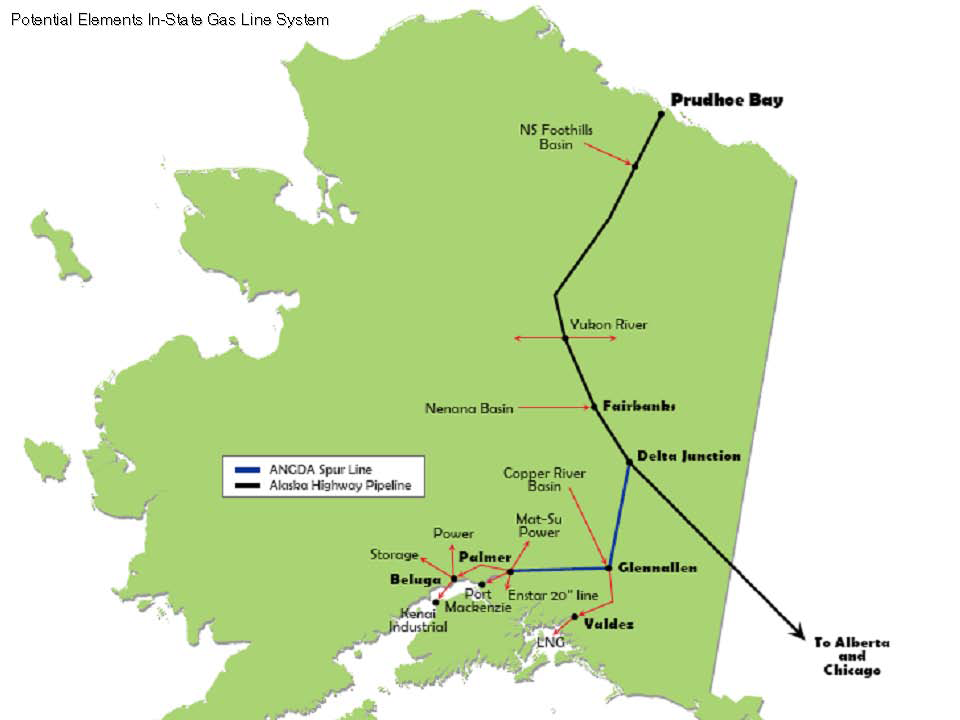

In the Alaska Natural Gas Pipeline session, Tony Palmer, vice president Alaska Development for TransCanada Corporation, provided an informative and interesting overview of his company’s capabilities, including the fact that TransCanada has been issued a license to build the 1,715-mile Alaska Gas Pipeline from the North Slope gas fields down the Alaska Highway to an existing pipeline network in Alberta, Canada.

Palmer, who is leading his company’s effort to build the multibillion pipeline project, pointed out that TransCanada had thought long and hard before they made the decision to also put forward an alternative pipeline route. “We did so consciously and have indicated to our potential customers that in the Open Season that will be concluded by July 2010 they will have the opportunity to direct where they want their gas to go.

Palmer said that at the end of the day TransCanada is a pipeline company and we move gas to the destinations that our customers tell us to.

“Although we know there are significant challenges to moving Alaska gas to the international market,” said, “if our customers can solve that riddle then TransCanada is prepared to build them a pipeline.”

Continuing, Palmer pointed out that he had been asked many times recently as to whether or not the Alaska Pipeline Project was now dead because of natural gas prices.

He said, “I testified last summer for 59 days before the Alaska legislature. At that time, natural gas prices were $10 to $12 and rising. Today, prices are around $4 and appear to be falling. This is a project that will come into service, in the best case, in 9½ years and then be in service for 25 to 50 years beyond that. Clearly, natural gas prices over a six month period will not determine the fate of this pipeline project.

“We will have to be aware of that but that is not what drives this project.”

He also spent time discussing the $12 billion Keystone Pipeline TransCanada is building to move more than a million barrels of oil from western Canada to Cushing, OK, that will be completed in about a year.

A second phase expansion will bring oil all the way to Houston and be complete by 2012.

“That is a 4,000 mile oil pipeline,” he said, “which is more than double the distance of Alaska Pipeline from Prudhoe Bay to Alberta.”

“I don’t mean to diminish the scale of the Alaska Gas Pipeline project,” he said. “It is massive, but it is not unprecedented for our company.”

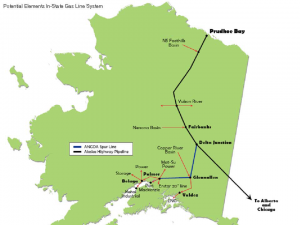

Harold Heinze, CEO, Alaska Natural Gas Development Authority (ANGDA), discussed the challenges of meeting future energy demand and the importance of the proposed Alaska Gas Spur Line connecting the Cook Inlet natural gas infrastructure with a supply coming off the North Slope via the much larger proposed TransCanada pipeline.

Also in the session, Drew Pearce, director, Federal Office Alaska Natural Gas Pipeline and Mark Myers, coordinator, Alaska Gasline Inducement Act, discussed the need for and challenges of getting Alaska’s North Slope natural gas to market.

Other highlights at the conference included an entertaining and informative discussion by Mark Mercer, vice president, T.G. Mercer Consulting Services Inc., that focused on the importance of pipe arriving on time. Also, Chris Larsen, Industrial Development, NGSF Railway and Curt Gauthe, managing director, Cooper Consolidated, gave thought-provoking discussions on this timely subject.

Comments