September 2019, Vol. 246, No. 9

Features

Liquids Lines Run Deep In North America

By Richard Nemec, Contributing Editor

In mid-2019, the U.S. Energy Information Administration (EIA) counted 200 liquid pipeline projects ongoing nationwide. At the same time, energy consulting firm ClearView Energy Partners tracked 79 separate legal appeals against liquid and natural gas federal permitting projects.

That represented from six different litigant sectors and 218 regulatory appeals of decisions covered by 20 separate federal laws, the Washington, D.C. consulting firm added.

In assessing what is happening with liquid energy infrastructure projects throughout North America, permitting challenges have to be followed as closely as construction diagrams. Legal and regulatory entanglements are an unavoidable reality as serious projects unfold.

Between 2010 and 2018, U.S. crude oil production doubled and about 70% of the growth was in the Gulf Coast region. During a five-year span of 2014 through 2018, the Gulf region crude production grew from 5.2 MMbpd to 7.1 MMbpd.

The bulk of that growth came from the Permian Basin in west Texas and southeast New Mexico, according to EIA liquids statistics. Since 2015, the Gulf has been a net recipient of crude oil (from the Bakken in North Dakota and elsewhere), reversing its previous status as a net shipper.

In contrast to the current U.S. policies aimed at “dominating” the global energy market, Canada’s current Liberal government has conveyed a somewhat anti-oil and gas growth in its policies, sentiments and attitudes. Focus is on transitioning away from fossil fuels at a time when energy industry observers are recommending growing oil and gas exports.

There are new petrochemical and pipeline projects being built in Alberta, but according to Chris Bloomer, CEO of the Canadian Energy Pipeline Association (CEPA), “This doesn’t really get us the ability to grow and move our products to other areas of the world besides the United States; right now, we’re certainly well below what our potential is over the long term.”

EIA and the industry players for most of the past two years have been reiterating that Permian production increasingly was outpacing the amount of takeaway infrastructure capacity in pipelines and processing.

Necessarily, it has prompted a large expansion of crude oil pipeline infrastructure that was still ongoing in late summer 2019. EIA reported nine intrastate crude oil pipeline projects that had been announced or under construction with in-service dates between late 2019 and 2021. “These projects are planned to move crude oil throughout Texas and Louisiana to further alleviate regional constraints,” EIA analysts opined.

Prior to this year, the Interstate Natural Gas Association of America (INGAA) hired ICF to study “North America Midstream Infrastructure through 2035,” supporting a conclusion of “continued significant development.”

ICF assumed that midstream infrastructure investment would peak in 2019, but “nonetheless remain robust through the 2035 study horizon, driven by a continuing surge in unconventional resource development.” ICF projected capital expenditures (capex) from 2018-2035 for both oil and gas infrastructure to top $790 billion, averaging about $44 billion annually.

Industry pundits, such as the American Petroleum Institute’s (API) Mark Green are trying to understand that more efficient governmental permitting for energy infrastructure projects doesn’t mean oversight and environmental reviews go away. To the contrary, the oversight work continues, but in theory on a streamlined, more cost-effective basis.

“Cutting red tape will help solve the problem of energy disparity in America by providing energy to currently under-served regions without compromising environmental protection or public safety,” Green said.

Commentators like Green want to catch the attention of more project engineers to accept the fact that the federal review and permitting process on these new and replacement projects are the keys for safe and responsible pipeline construction and operation.

API has completed a videotape of work on the Plains All American Pipeline Co.’s Cactus II oil pipeline, which was scheduled to start in the 2019 summer. “During a visit to the construction zone last fall, I saw technologies and a safety culture at work together to ensure that, as API said in the videos, U.S. pipelines are safer than ever,” Green wrote.

Indicative of liquid pipe projects on both sides of the U.S.-Canadian border, Cactus II is a proposed 500-mile line to take increasingly plentiful Permian oil supplies to Corpus Christi, a ready model for U.S. infrastructure targeted at hauling crude to market from one of the nation’s premier producing regions.

Construction schedules were staggered in parts of the route and restricted to certain times of day to allow hunters to go out for early morning and evening forays. When work progressed along the pipeline route there was cutting, refining, and welding of pipe segments and ultimately x-raying to assure the quality of the welds.

This is where advances in technology, equipment and skilled pipeline crews merge into a production harmony that the bloggers like Green capture using a form of industrial poetry to describe the tableau.

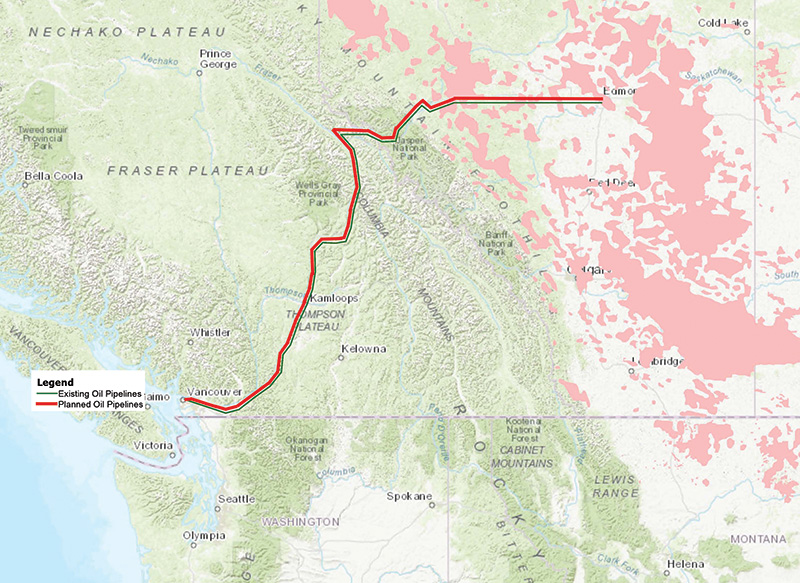

In Canada, where industry leaders are worried about a continued pull back in energy investments and projects, there are long-standing liquids line additions waiting for the final political/permitting hurdles on both sides of the international border. These are TC Energy’s Keystone XL oil pipeline, Enbridge Energy Partners’ Line 3 replacement program, and the Canadian federal government-sponsored Trans Mountain oil pipeline replacement project in western Canada. Collectively, the three projects represent an increased capacity of more than 1.7 MMbpd.

For Keystone, with all the pipe ordered and a lot of pre-pipeline-laying work completed, TC is awaiting a Nebraska state supreme court decision in the second half of 2019 on an alternative route through the state to its terminus in Steele City, NE. Line 3’s backers need more permits from the state of Minnesota and the delays have pushed its projected in-service date to the second half of 2020.

In early summer Trans Mountain received Canadian final approvals and set an August 2019 date for beginning construction at both the Edmonton inlet and Vancouver Harbor outlet only to receive yet another delay in mid-July when the National Energy Board (NEB) granted a second chance to protest for the 2,800 landowners along the pipeline route.

While these many U.S. and Canadian projects work to get through often arduous permitting processes, there are sections of pipe being stacked horizontally, waiting to be delivered to assembly points along their respective routes.

In describing the Cactus II project API’s Green, a former Washington, D.C.-based journalist, reported on “rocky terrain dotted by nothing taller than scrub brush and mesquite trees,” describing a “sucker hoe and suction device” lifting 8,000-pound pipe sections on trucks as the midstream crews move forward, doing enough to keep their energy artery replacements alive. In a new NEB application, Trans Mountain also called for a start on pipe additions needed to nearly triple capacity to 890,000 bpd in the 688-mile pipeline.

South of the Canadian border, industry specialists like Green say that the updated U.S. federal review is critical to maintaining a robust energy infrastructure network. In his examination of the Cactus II project construction on the group he found “attention to safety and precise operations, supported by technology.”

Green credits professionalism among Plains All American and other U.S. pipeline crews as the reason the industry has set a record for safely delivering liquid products.

“This is the context for a new era of energy infrastructure construction,” Green wrote last spring.

Among others in the industry, API is supporting passage by Congress of a pipeline safety reauthorization bill that in June was rolled out by the Trump administration’s Department of Transportation (DOT), which includes the Pipeline and Hazardous Materials Safety Administration (PHMSA). In its 20 sections, the reauthorization bill covers everything from safety incentives and program grants to LNG facility reviews and criminal penalties.

“It is important that the industry, regulatory environment and PHMSA be positioned to meet current and future safety challenges,” according to API’s Robin Rorick, vice president for midstream/industry operations.

While the predictions on global oil prices in 2019 have been all over the charts and graphs, industry analysts tend to all be bullish on the continued development of new infrastructure.

In INGAA’s ICF study from last year there is the prediction that the infrastructure boom “had not run its course,” and API’s Chief Economist R. Dean Foreman cited Permian oil pipeline expansions such as the Phillips 66 Partners (75%) joint venture with Andeavor (25%) Grey Oak, Enterprise Products’ Seminole Red, and the earlier mentioned Cactus II pipelines as “more than accommodating the expected production growth in the 2019-20 period.”

Seminole Red is a 200,000 bpd line put in service early in 2019 to ship Permian supplies to Houston. Genscape, the global in-field oil/gas facilities monitoring and analytical firm, confirmed that one of the two turbines at the Coupland, TEXAS, pumping station was active at the time of imagery collection, indicating to industry analysts that the pipeline was operable, at least under a limited capacity.

Genscape also collected infrared imagery at the Millersview, Texas, pumping station. The two turbines associated with crude service at that location were offline at the time of imagery collection. This is indicative of how modern technology tracks energy infrastructure.

Slated to begin operating at the end of 2019, the 850-mile Grey Oak oil pipeline is aimed at bringing more Permian supplies to Corpus Christi. Phillips 66 officials expect the new Texas pipeline will “create reliable access to crude oil in the region, bringing more growth to the Texas energy industry.” Gray Oak will help new energy being found and produced in Texas get to refineries, manufacturers and, ultimately, consumers.”

Echoing remarks from others in the industry, the Phillips engineers talk about “many challenges” in trying to move more liquid product from the Permian and Eagle Ford, among other major basins.

“Supplies are often bottlenecked and shipped by truck; Gray Oak means more oil will be transported by pipeline, providing refineries in Texas and abroad with access to U.S. oil. The Gray Oak Pipeline project supports continued production growth in the Permian Basin and will improve the state economy,” Phillips touts on its website.

The 79 separate legal appeals ongoing represent a more common bottleneck than the physical ones in parts of the nation’s massive infrastructure system. An example emerged in late July involving both sides of the U.S.-Canada border for Enbridge’s Line 3 replacement pipeline on which opponents have challenged the work in the Minnesota Supreme Court.

Opponents challenge the validity of the project’s environmental review, a common tactic, but the PUC has rebutted that allegation, calling the review “adequate in all respects.”

Bidding to replace its aging oil pipeline across northern Minnesota, Enbridge received support from a state appeals court earlier in the summer when it upheld most of the environmental impact statement but sent the case back to the PUC for more proceedings because the review had not considered the impact of a possible spill into Lake Superior watershed. Environmental and tribal groups want the state Supreme Court to support other challenges, so the project is still far from a done deal.

As indicated in some parts of this report on the liquid projects, the Indigenous Peoples in Canada and U.S. Native American tribes have the legal and political wherewithal to be a factor on both sides of major energy infrastructure projects as part of the opposition or as part of the supporters.

A footnote on that happened this summer when the leading tribe opposing the Dakota Access oil pipeline, the Standing Rock Sioux, whose reservation is close to part of the disputed pipeline route announced it plans to launch a solar farm in parts of North and South Dakota that will provide all the electricity needs to 12 other reservation communities. The Sioux Nation has an indigenized program promoting projects within the reservation boundaries.

In Canada, CEPA’s Bloomer said the industry’s relationship with the nation’s original citizens is “evolving in a positive way,” reiterating that there are 634 different First Nation tribes and 1.67 million Canadians who classify themselves as Aboriginals.

Industry backers cite a full-scale effort in recent years to engage the First Nation citizens in training and working with the communities. They point to many similarities between the Canadian and the U.S. tribes, but there are also three distinctions, the major one being the fact Canada’s Indigenous Peoples’ rights are embedded in its Constitution, including the right to be consulted on issues and major projects.

More to the current theme of legal and political hurdles in the liquid infrastructure space is C-69, a new Canadian federal policy on major project environmental reviews, passed earlier this year as legislation and is now going through the regulatory implementation phase, which gives industry voices like CEPA a chance to be heard, according to Bloomer. It has created a new Canadian national regulator into which the existing all-powerful NEB will transform. There will be two sides to the regulatory entity – the information reporting side and the regulatory side.

The regulatory implementation will roll out within a year, during which CEPA hopes to be able to weigh in, Bloomer said.

C-69’s change for the NEB is that it will stop making environmental reviews of large projects. That will be done by the Impact Assessment Agency of Canada, replacing the Canadian Environmental Assessment Agency (CEAA), and the NEB’s equivalent of the U.S. Energy Information Administration (EIA) will be put in a separate agency. The larger projects that go through the new environmental review unit will still have their operations ultimately regulated by NEB, Bloomer said.

The Toronto-based C.D. Howe Institute, early in 2019, published a study entitled “A Crisis of Our Own Making: Prospects for Major Natural Resource Projects in Canada” predicting that C-69 could “further discourage” investment in Canada’s energy sector. It was co-authored by the Institute’s Associate Research Director Grant Bishop and a former deputy energy minister for Alberta province, Grant Sprague.

“Under Canada’s federal legislation for environmental assessments, most project approvals since 2012 have withstood court challenges,” Bishop and Sprague wrote. “However, courts’ findings that the federal government failed to fulfill its constitutional duty to consult affected Indigenous peoples have resulted in the quashing of three approvals, including those for the Northern Gateway Pipeline and Trans Mountain expansion.”

In the midst of unending hurdles for major infrastructure projects, Canadians are trying to figure out what it will take to reawaken investment in major projects, Bloomer told P&GJ. With the federal government backing away from oil and gas, people see a slow or no-growth proposition in Canada, he said quite realistically.

The irony is that the nation could easily produce twice the oil and gas now being produced at greatly reduced costs, Bloomer thinks. “Emissions in the oil sands industry have come down 30% to 35%,” he said.

Bloomer strongly argues that the industry has made tremendous strides economically and environmentally, but the Trudeau administration doesn’t recognize these accomplishments. “Until this sentiment changes, it is going to be hard for folks to develop this industry to what it could be,” Bloomer said. “We could be a major global LNG player and we could double our crude production.”

Woulda, coulda, shoulda looms large in the northern climes. P&GJ

Richard Nemec is P&GJ’s Los Angeles correspondent who contributes regularly to this publication. He can be reached at rnemec@ca.rr.com.

Comments