Canadian Pension Fund Takes 50% Stake in BridgeTex Pipeline

Plains All American and Magellan Midstream have completed the sale of a 50% stake in BridgeTex Pipeline to OMERS, the defined benefit pension plan for municipal employees in Ontario, Canada, and its infrastructure investment manager.

Plains retains a 20% interest following the $1.438 billion transaction, while Magellan will continue to operate the Permian-to Gulf Coast pipeline and own a 30% interest.

Originally developed as a 50/50 venture between Magellan and Occidental Petroleum, the BridgeTex Pipeline began commercial service in September 2014 with an initial capacity of 300,000 bpd. Occidental agreed to sell its interest in the project to Plains only two months later. BridgeTex currently has a capacity of 400,000 bpd, and is being expanded to 440,000 barrels per day by early 2019.

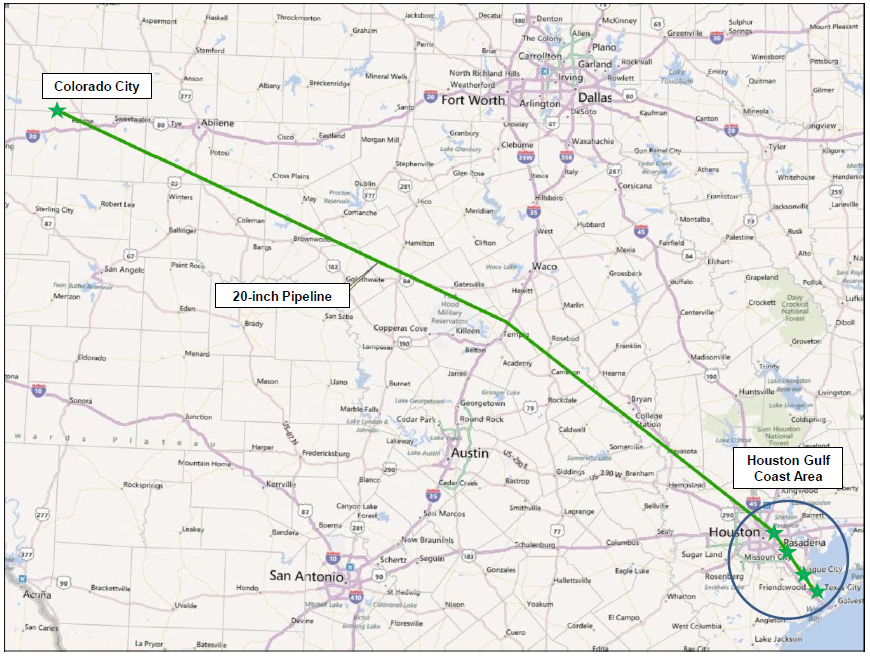

The pipeline delivers crude oil from Colorado City in West Texas to Houston, with further connectivity for BridgeTex shippers to the Texas City area. At Colorado City, BridgeTex pipeline sources crude oil from Plains’ Basin and Sunrise pipeline systems. BridgeTex delivers volumes into Magellan’s East Houston terminal and Magellan’s Houston crude oil distribution system with connection to refineries in Houston and Texas City as well as to marine export capabilities via Magellan’s Seabrook Logistics joint venture terminal.

OMERS Infrastructure is one of Canada's largest defined benefit pension funds, with net assets of more than C$95 billion.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- U.S. to Acquire 3 Million Barrels of Oil for Emergency Reserve in September

- AG&P LNG Acquires 49% Stake in Vietnam's Cai Mep LNG Terminal

- BP's Carbon Emissions Increase in 2023, Ending Decline Since 2019

- Texas Sues EPA Over Methane Emission Rules for Oil and Gas Sector

Comments