July 2018, Vol. 245, No. 7

Global News

Global News

Report: Produced Water Creates Growing Risk to Permian Growth

As operators continue ramping up Permian Basin activity and takeaway demand, operational water challenges are emerging as a growing material risk to future upstream profitability and production, according to a new Wood Mackenzie study.

Ryan Duman, principal analyst with Wood Mackenzie’s Lower 48 upstream team, said the firm expects more than 2 MMbpd of oil supply growth in the next five years.

“While attainable, the list of operational risks grows too, and the least appreciated of these is produced water,” Duman said. “The combination of rising volumes and higher disposal costs threaten to shift cost curves and pose a growing risk to oil production growth in the Permian.”

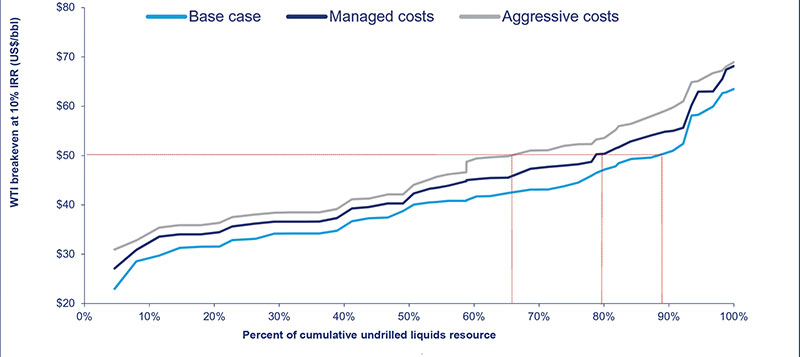

The study, Permian produced water: slowly extinguishing a roaring basin?, modeled various scenarios of rising water cuts and growing water management costs. In its “aggressive” future cost scenario, breakeven costs in the Midland and Delaware sub-plays could increase by $3-$6 per barrel, potentially curbing the growth of future Permian oil supply by 400,000 bpd by 2025.

“Water risks to date have largely been described as a cost issue, but as projects continue to build scale, the risks become more serious,” Duman said.

Unlike some of the other subsurface constraints and risks facing the Permian, there are ways operators can mitigate risks from produced water. “One of the best opportunities for operators to reduce water costs is by investing in pipeline infrastructure, limiting the amount of trucking and collaborating with offset operators,” Duman said.

Devon Energy Sells EnLink Midstream Stakes for $3.1 Billion

Devon Energy agreed to sell its ownership interests in EnLink Midstream Partners and Enlink Midstream to an affiliate of fund manager Global Infrastructure Partners (GIP) for $3.1 billion.

As part of this transaction, Devon will extend its fixed-fee gathering and processing contracts with respect to the Bridgeport and Cana plants with EnLink through 2029. The company’s minimum volume commitments for these agreements will expire at the end of 2018.

EnLink said it will continue to maintain a strong commercial relationship with Devon through long-term contracts as the companies work alongside each other to maximize returns in the STACK, redevelop the Barnett Shale and team up on new potential opportunities, such as crude gathering in the Delaware Basin.

Trans Mountain Pipeline, Expansion Selling for C$4.5 Billion

Kinder Morgan Canada Limited agreed to the purchase of the Trans Mountain Pipeline system and the expansion project (TMEP) by the Canada government for C$4.5 billion (US$3.46 billion).

As part of the agreement, the government will fund the resumption of TMEP planning and construction work by guaranteeing TMEP’s advances under a separate federal recourse credit facility until the transaction closes.

“The outcome reached represents the best opportunity to complete TMEP and thereby realize the great economic benefits promised by that project,” said KMI CEO and KML Chairman and CEO Steve Kean. Earlier, Kinder Morgan halted essential spending on the project and said it would cancel it altogether if the national and provincial governments could not guarantee it.

Canada has the world’s third-largest oil reserves, but 99% of its exports go to refiners in the U.S., where Canadian oil sells at a discount.

Solaris Water Midstream Starts Pecos Star Operations

Solaris Water Midstream began operations on the first phase of its 300-mile Pecos Star water system, which is designed to serve oil and gas producers in the Delaware Basin of West Texas and New Mexico.

Phase One of Solaris Water’s Pecos Star System comprises 50 miles of 12- and 16-inch produced-water pipelines, multiple disposal-well connections, the ability to supply recycled water and freshwater wells and ponds.

The build-out of additional phases is underway, with continuous construction expected over the course of the coming year. Upon completion, the Pecos Star System will include an extensive integrated network of more than 300 miles of high-capacity gathering and distribution pipelines ranging from 12 to 16 inches in diameter, dozens of disposal wells, storage ponds, aboveground storage and recycling facilities.

EPIC Secures Strategic Partnerships for Crude Oil Pipeline

Apache Corporation and Noble Energy committed to anchor the EPIC Crude Oil Pipeline, which will run side-by-side with the EPIC NGL Pipeline for 730 miles from southeastern New Mexico to Corpus Christi, Texas. The pipeline will have an initial total capacity of 590,000 bpd, including 440,000 bpd from the Permian Basin and 150,000 bpd from the Eagle Ford shale. Apache and Noble Energy have secured 75,000 bpd and 100 bpd of firm capacity, respectively.

As part of their strategic partnerships, Apache will have an option to acquire a 15% interest in the pipeline, with Noble having an option to acquire a 30% interest, as well as a 15% interest in the EPIC NGL Pipeline. All options expire in the first quarter of 2019.

The EPIC Crude Oil Pipeline will extend from Orla, Texas, to the Port of Corpus Christi, Texas. The project includes terminals in Orla, Pecos, Saragosa, Crane, Wink, Midland, Helena and Gardendale, with Port of Corpus Christi connectivity and export access. Right-of-way is 100% secured for the first two phases of the system, and construction is expected to commence in the fourth quarter of 2018. The pipeline expected to be in service in the second half of 2019.

Nord Stream 2 Gains Swedish Approval

Russia’s Gazprom’s proposed Nord Stream 2 natural gas pipeline from Russia to Germany received construction approval from Sweden and Russia, leaving only Denmark as the sole nation remaining yet to decide on the project.

Nord Stream 2 has already obtained permits for construction and operation of the pipeline system in Germany and Finland, and Gazprom has vowed that a rejection by Denmark would not stop it from completing the 1,230-km (764-mile) pipeline, but could delay the project. The permit from Sweden’s Ministry of Enterprise and Innovation covers an about 510-km route section in the Swedish Exclusive Economic Zone.

The controversial Gazprom project has been opposed by the United States on the basis of “European energy security” and by European nations concerned over growing reliance on Russian gas and the financial impact on Ukraine, which will lose income as natural gas deliveries shift to Nord Stream 2 and bypass its pipelines.

Poland’s prime minister has been increasingly vocal about the project, calling it a “new hybrid weapon” that Moscow will use it to undermine NATO and the European Union.

First LNG Shipment Leaves Cameroon Plant Built on Old Tanker

Golar LNG has started commercial operations at its pioneering floating liquefied natural gas (FLNG) production platform in Cameroon, $70 million under budget, Reuters reported.

The first of its kind, the Hilli Episeyo vessel was converted from an aging LNG tanker for $1.2 billion. The successful start-up removes uncertainty about the risks associated with squeezing a liquefaction plant typically spanning hundreds of acres on land into a single, 1970s-built ship with four liquefaction units bolted onto its sides.

It produced the first LNG on March 12 but only exported its first cargo in May, to China, after technical issues delayed a ramp-up in production. After continuously producing LNG for 16 more days, Golar’s clients have contractually accepted the facility, marking its commercial start, Golar said in a statement. Golar is in talks to develop similar projects in Senegal-Mauritania with BP and with Ophir Energy in Equatorial Guinea.

SoCalGas Warns Supply Could Fall Short

Southern California Gas (SoCalGas) has cautioned that pipeline outages and restrictions on the Aliso Canyon gas storage facility could reduce its ability to deliver natural gas this year to a level even lower than California state regulators and others have predicted.

Regulators, power companies and grid operators issued a technical report in May warning of a “moderate threat” to gas and electric reliability this summer and a “more serious threat” next winter.

“We remain concerned that some of the assumptions made in the technical assessment are overly optimistic,” SoCalGas spokesman Chris Gilbride said.

The SoCalGas system has been operating at less than full capacity because of the pipeline outages and restrictions on the use of Aliso Canyon, the utility’s biggest storage field, which suffered a devastating leak between October 2015 and February 2016.

Rover Pipeline’s Full Mainline B Goes into Full Service

Energy Transfer Partners’ Rover Pipeline received approval from the Federal Energy Regulatory Commission (FERC) to begin service of the Supply Connector B and full Mainline B pipeline segments.

Service to the Market Zone north segment of the pipeline, with deliveries into the Union Gas Dawn Storage Hub in Ontario, Canada, will begin by way of the Vector Pipeline Connection in Michigan.

This latest approval allows for 100% of Rover’s mainline capacity, 3.25 Bcf/d of natural gas, to be placed into service.

The FERC decision, however, did not allow gas to flow on two key laterals – the Burgettstown and the Majorsville – connecting to supply areas.

Rover transports natural gas from the Marcellus and Utica Shale production areas to markets across the United States, as well as into the Union Gas Dawn Storage Hub.

GITA, Pipeline & Gas Journal Launch Technology Conference

The Geospatial Information and Technology Association (GITA) and Pipeline & Gas Journal have agreed to produce the annual Pipeline Technology Forum, including the 27th GITA Oil and Gas Pipeline Conference.

The Pipeline Technology Forum will be held Oct. 16-17 in Houston and replace a former GITA annual event known as Pipeline Week, according to GITA President Mark Limbruner.

“The GITA board and I are extremely happy to have engaged with Gulf Energy Information to produce our 27th annual pipeline event. Our members and attendees should look forward to a refreshed and exciting conference,” Limbruner said. “Gulf’s ability to co-brand our event with the leading trade journal in the market, Pipeline & Gas Journal, and its data for the pipeline industry, make it an ideal partner for GITA and for a vibrant and growing industry segment. The combination will also significantly increase the educational value of our annual conference.”

More than 100 exhibitors and over 500 attendees are expected at the event, which will include general sessions and two tracks of technical presentations on the use of geospatial technologies, pipeline software and other applied technologies for the pipeline industry. GITA also will hold its board and association meetings during the event.

“We are thrilled to be working with GITA to put on the annual conference and to further learning and best practices for geospatial and pipeline technology professionals,” said Brian Nessen, group publisher for Pipeline & Gas Journal and Underground Construction. P&GJ

Comments