May 2018, Vo. 245, No. 5

Features

Iran’s Future Clearly Points to Gas

By Nicholas Newman, Contributing Editor

With the lessening of U.N. sanctions and expected inflow of foreign capital and technology, it is predicted that gas will be the basis of Iran’s future prosperity and foreign exchange earnings.

The country is home to 33.5 Tcf of natural gas, equivalent to 18% of the world’s total gas reserves, and has the fourth-largest oil reserves, estimated at 158.4 billion barrels. Iran’s gas production was 38.6 Bcm in 1995 since which time it has burgeoned to 227 Bcm in 2016.

In the first nine months of 2017, the National Iranian Gas Company (NIGC) distributed 515 MMcm/d of natural gas, of which 200 MMcm/d was destined for power plants, 147.4 MMcm/d was supplied to households and 103 MMcm/d went to industry. The commercial and small industry sectors received 45 Mcm/d, while the remainder entered storage.

Despite its massive gas reserves, Iran has struggled to meet domestic demand for gas let alone exports. Since 1997 Iran has imported gas from neighboring Turkmenistan to meet demand.

“In the winter months, when gas is used for heating, industrial consumers are still regularly taken off the grid to ensure households are supplied with enough gas, and as long as this is the case, a barrier remains to larger Iranian natural gas exports,” explained David Ramin Jalilvand, a Berlin-based analyst and consultant.

Years of insufficient domestic investment in gas production and distribution has meant capacity has not kept up with burgeoning demand for power. U.N. economic sanctions, which only began to be lifted as late as 2015, restricted access to foreign funding and technology. In sum, years of insufficient investment have prevented Iran from reaching its energy potential.

Gas Sector

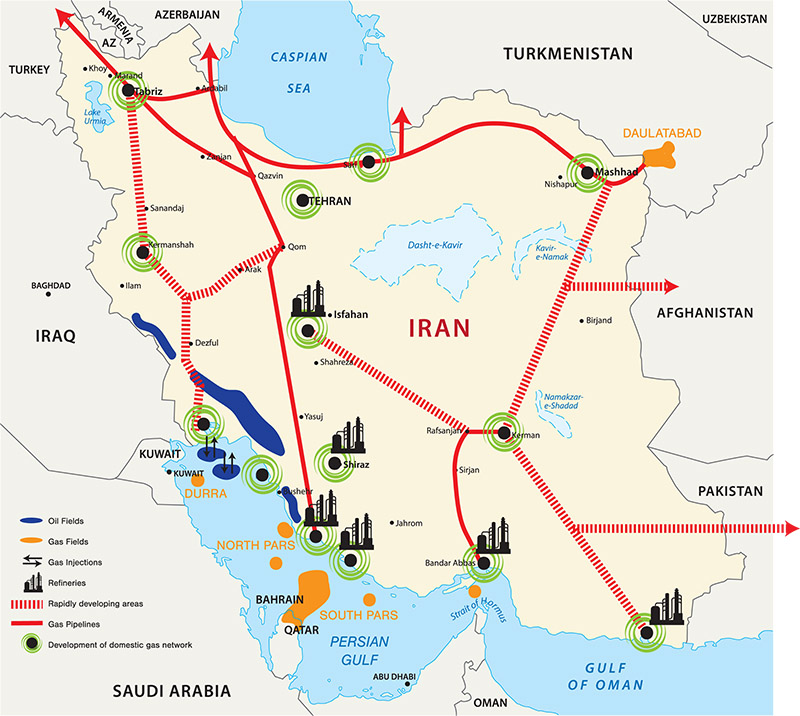

The NIGC operates a pipeline network of 36,000 km to serve the needs of 92% of the Iran’s population of 82 million, including major cities such as Tehran, Tabriz and Isfahan. NIGC is also responsible for associated gas infrastructure, gas supply networks and consumer connections, as well as underground natural gas storage facilities. Current plans envisage a pipeline network of 45,000 km by 2025.

Gas production

Today, much of Iran’s gas production is located along its southern coast, extending from the Euphrates and Tigris delta in Iraq to just north of Qatar. The 51 Tcf South Pars gas field is shared with the world’s leading LNG exporter, Qatar. South Pars provides 575 MMcm/d or about two-thirds of Iran’s total gas output.

A trickle of foreign funds after the lifting of U.N. sanctions on Iran has enabled gas output to increase to 800 Bcm last year. Additional foreign investment and western technology could expand production to 1,000 Bcm in coming years. However, production in the South Pars field is threatened by a decline in pressure. The existing fleet of 40-odd, 2,000-ton rigs is not going to be powerful enough after 2023 to maintain current output levels.

“Iran needs to invest at least $2.5 billion in 15 new 20,000-ton platforms, each carrying several giant compressors in the South Pars field in order to maintain output, and Iran does not have the money or the technology to build such rigs,” said Azerbaijan gas expert Dalga Khatinoglu.

New Investment

The gradual lifting of sanctions on Iran has encouraged the re-entry of western energy companies. For instance, Total, working with China National Petroleum Corporation and National Iranian Oil Company (NIOC) subsidiary Petropars, plan to invest an initial $1 billion in the South Pars gas field – an investment that could rise to $4.9 billion. In addition, Eni has signed a provisional agreement with NIOC to develop the Kish gas field, as well as the third phase of the Darkhovin oil field in southern Iran.

Meanwhile, the national oil companies of Kuwait and Iran are planning to develop their jointly owned offshore 28 Bcm Arash Gas Field in the Persian Gulf.

Current Projects

Currently, Iran supplies piped gas to power plants in Armenia, Azerbaijan, Iraq and Turkey and receives a portion back in the form of electricity. Armenia is the main destination for Iranian gas exports taking nearly seven and a half times the amount sent to Iraq [Table]. Nevertheless, relations with Iran’s export markets are not running smoothly.

|

Markets |

Exports |

Imports |

|

Armenia |

370 |

- |

|

Azerbaijan |

6 |

- |

|

Iraq |

50 |

- |

|

Turkey |

10 |

-` |

|

Turkmenistan |

|

10 |

|

Sources include Reuters, Bloomberg, Azernews |

|

|

For instance, in 2016 the International Court of Arbitration ordered Iran to reimburse $1.9 billion to Turkey, a sum equivalent to 13% of its total sales. Turkmenistan has provided intermittent gas supplies to Iran’s northern regions, where winter temperatures can fall to as low as -20 degrees C.

Notwithstanding this, Iran has a standing dispute over the price of Turkmenistan gas. The opening last year of a new 160-km, 42-inch pipeline connecting the cities of Damghan to Neka could reduce the need for Turkmenistan’s gas to meet demand in Iran’s north.

There are several proposals to increase gas exports and find new markets. However, David Ramin Jalilvand is cautious, saying “under a best-case scenario, Iran might succeed with adding Pakistan and Oman to its customers. But this should not be taken for granted as domestic demand continues rising while Iran is further diversifying its economy.”

The proposed projects include a $1.2 billion, 200-km pipeline connecting the Iranian gas network at the port city of Asalouyeh in the Persian Gulf to Kuhmobarak, Hormozgan Province, by the Sea of Oman. From there, a subsea pipeline would be laid to Oman’s Sohar Port. One-third of projected Iranian gas exports to Oman are destined for the sultanate’s Qalhat LNG export plant with the remainder available for domestic consumption.

In addition, a memorandum of understanding was signed in December 2017 by NIOC, Russia’s Gazprom and Iran’s Oil Industry Pension, Saving and Staff Welfare Fund on the proposed Iran LNG project. The first phase of the Iran LNG project provides for construction of two 5.25 mtpa gas liquefaction trains, Gazprom said, increasing to 21 mtpa with second-phase construction of two additional process trains.

In contrast, the proposed construction of a 2,775-km pipeline linking Iran’s South Pars field with industrial centers in Pakistan is in doubt due to both Saudi opposition and the completion of Pakistan’s two LNG import facilities near Karachi, as well as the planned addition of two LNG plants to meet anticipated growth in natural gas demand from Pakistan.

The lessening of sanctions could allow Iran to export LNG, but as Dalga Khatinoglu points out, “Iran needs at least $7 billion investment” for completion of the LNG plant at the port of Tombak. However, in February 2018 Reuters reported Total was in talks with NIGEC to buy a stake in the project.

One thing is clear: Without substantial investment and access to western energy technology, Iran is unlikely to be able to meet rising domestic demand, let alone satisfy its gas-export ambitions. P&GJ

Comments