May 2018, Vo. 245, No. 5

Features

Marcellus-Utica: The Juggernaut Continues

Marcellus-Utica: The Juggernaut Continues

By Kevin Petak, Vice President in Natural Gas and Liquids Markets, ICF and Julio Manik, Technical Specialist, ICF

Just a little over a decade ago, one of the world’s largest gas-producing basins, Marcellus-Utica, was just beginning to develop. Since then, the area’s supply of natural gas and liquids’ has skyrocketed, and it now produces close to 25 Bcf/d1 with no signs of slowing down.

The Marcellus-Utica is hardly a run-of-the-mill gas play. Compared to other basins, ICF estimates that it has the potential to produce a quadrillion cubic feet of natural gas2. The rapid, exponential growth spells tremendous opportunities for the Northeast as a source of new jobs, lower energy prices and industrial opportunities. The potential is so great, in fact, that it may leave many asking, “What should we do with so much of a good thing?”

Ultimately, to leverage the opportunities created by this powerful resource, we must understand how markets could develop in tandem with the burgeoning supply, devote resources to developing proper infrastructure to support it, and consider the potential risks for its development.

Bright Future

In the short term, U.S. natural gas production saw record growth in 2017, with dry gas production climbing from roughly 71 Bcf/d at the year’s onset to roughly 78 Bcf/d by the end of the year, ultimately yielding an astounding 10% growth3. With its dry gas production growing from 22 to 26 Bcf/d, it should come as no surprise that the Marcellus-Utica led the way for this wave of growth over the course of the year.

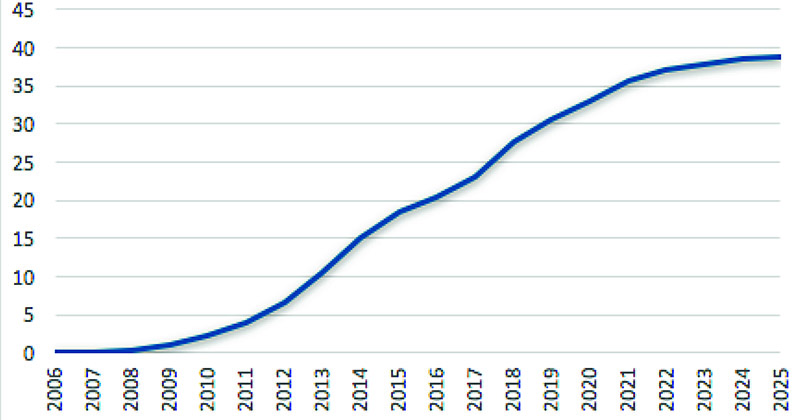

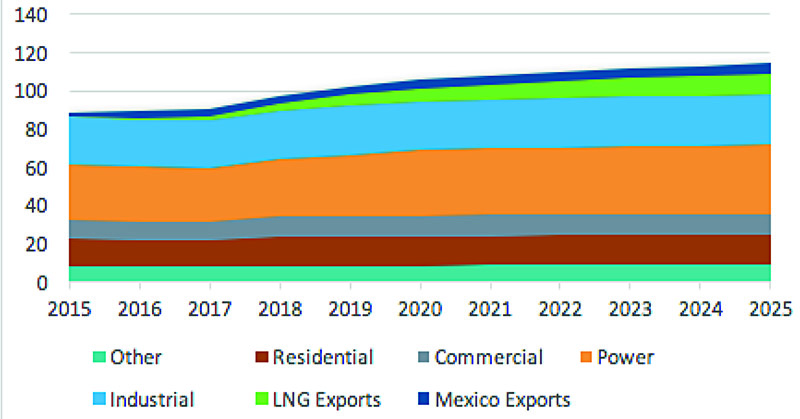

And according to long-term forecasts by ICF, this record growth is projected to continue. Forecasts show that by 2025 the basin’s gas production will approach 40 Bcf/d, a phenomenal growth of roughly 7% each year (Figure 1). Over the same period (Figure 2), natural gas use in the U.S. and Canada is projected to increase to nearly 115 Bcf/d4, all made possible by the Marcellus-Utica production. This increased rate of production forebodes that, even as gas use rises, gas supplies will remain competitively priced and natural gas prices will remain relatively unchanged.

But how can just one basin account for so much supply growth? The answer is supported by three key findings. First, the area is geographically vast and rich in hydrocarbon content, and is home to quadrillions of cubic feet of gas resource. Second, deployment and advancement of horizontal well and fracturing technologies has led to robust “manufacturing” of the area’s gas and liquids, dramatically increasing recovery factors and making much of the area’s molecules economic to develop. And third, unlike some other shale plays, the area tends to be relatively homogeneous, so, there are a large number of potential well locations that are economic to develop. All of these findings point to a resource base that will continue to support robust producer activity.

Not the Destination

However, in order to tap the full potential of these supplies, the area needs the right oil and gas infrastructure to enable processing and transport of gas and liquids. Continued investment in and development of gas and liquid pipelines, as well as midstream facilities for gathering, processing and fractionation, are critical. Fortunately, the outlook for development is promising.

Currently, there are more than 10 major natural gas pipeline systems providing service in the area, many of which have been expanded to support the area’s incremental production over the past decade. Likewise, there are a number of pipeline projects already in the works with the potential to add 15 to 20 Bcf/d5 of incremental gas transport capability over the next decade, including the Mountain Valley Pipeline, Atlantic Coast Pipeline, WB Express and Nexus. In addition, there are a number of liquid pipelines under development, including Mariner East II, Utica Marcellus Texas Pipeline, and Shell Falcon Ethane.

Midstream facilities, including gathering lines, processing plants, and fractionation facilities also play an important role in enabling processing and liquid extraction for the area’s supplies. During recent years, the area’s athering lines have been expanded robustly, particularly in areas where multi-well pads have proliferated. According to a report by the U.S. Energy Information Administration (EIA), there are currently more than 30 processing facilities and 10 fractionators operating within the area and several more on the way.6

Overall, Marcellus-Utica activity will foster development of thousands of gas wells, roughly 5,000 miles of gathering lines, more than 11 Bcf/d day of new gas processing capability, more than 250,000 Bcf of fractionation capacity, and well over 7,000 miles of new pipeline between 2018 and 20257.

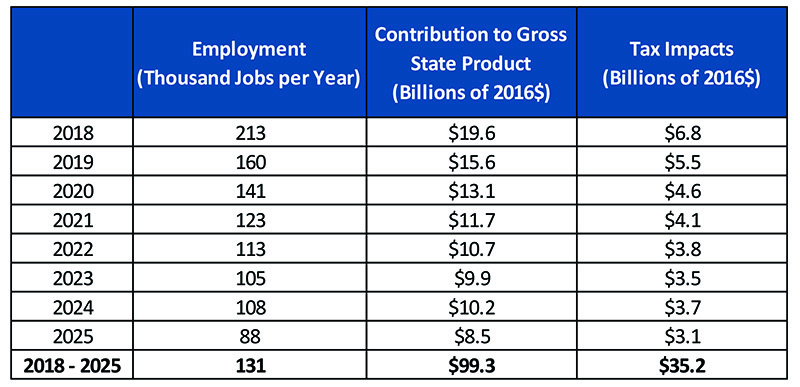

With data from an American Petroleum Institute (API) study completed by ICF (Figure 3), this level of infrastructure investment means big things for the economy, and not just on a regional scale. In the study, Marcellus-Utica development was projected to employ hundreds of thousands of people and add billions of dollars to the U.S. economy. Without accounting for the impact of the area’s energy savings or petrochemical activity, the study only brushed the surface of the total economic impact of these resources.8

What Could Go Wrong?

While the future looks bright for the Marcellus-Utica, it is important to consider that there are a range of issues that can affect future development.. Significant delays in the development of oil and gas infrastructure and slow market development could affect the pace of development. Environmental accidents, should they occur, could also impact resource development.

Such delays can impose significant cost increases on projects, dramatically increasing tariffs for capacity and ultimately rendering projects uneconomic, but the risk that is least understood is also the most significant: a lack of market development. Much of the incremental production from the area will require market growth; without such growth, the area’s incremental production would merely cannibalize production elsewhere, leading to significant gas-on-gas competition and much lower gas prices.

State and potentially federal greenhouse gas policies, depending upon how they develop, could have a significant effect on future domestic natural gas demand. While LNG, ethane, and propane exports are likely to grow significantly in the future, there is much uncertainty regarding the evolution and growth of international markets, and there are different views regarding trade policies and domestic energy development, particularly in key countries like China and India. These factors are certainly worth considering when looking at continued development of the area’s supplies, and create some risk for the area’s development.

Bottom Line

Marcellus-Utica has become a world-class gas play, a standing that is not likely to be threatened soon. The area’s gas production is projected to grow from roughly 25 Bcf/d at present to 40 Bcf/d by 20259. Over the same period, the area will support over 7,000 miles of incremental pipeline development, 5,000 miles of new gas gathering lines, over 11 Bcf/d of new gas processing capability, and 250,000 Bcf/d of new fractionating capacity10. While the future is bright for the area’s development, longer-term impediments may include slower market growth and environmental policy development. Infrastructure planning in the Marcellus-Utica should account for growth opportunities under a variety of future scenarios. P&GJ

Authors:

Kevin Petak is a vice president in Natural Gas and Liquids Markets for ICF. He is an expert in gas market analysis and supporting strategic planning from more than 30 years of experience in the energy industry. Petak has directed gas market modeling work for the National Petroleum Council, America’s Natural Gas Alliance, the American Gas Foundation and the Interstate Natural Gas Association of America.

Julio Manik is a technical specialist at ICF with more than 17 years of experience in the areas of energy modeling, engineering economics, and reservoir engineering. He is the lead analyst on projects related to hydrocarbon supply curves, oil and gas drilling and production, gas pipeline supply-demand modeling, midstream infrastructure analysis, economic impact analysis and issues related to reservoir simulation, multiphase flow in pipeline, and fluid PVT.

Footnotes:

1 PointLogic

2 ICF Hydrocarbon Resource Assessment

3 U.S. Energy Information Administration (EIA)

4 ICF Q1-2018 Base Case

5 ICF Q1-2018 Base Case

6 EIA-757 Processing Capacity, Natural Gas Annual Respondent Query System, U.S. Energy Information Administration.

7 ICF 2018 Midstream Infrastructure Report

8 U.S. Oil and Gas Infrastructure Investment Through 2035, An Engine for Economic Growth, American Petroleum Institute, April 2017.

9 ICF Q1-2018 Base Case

10 ICF 2018 Midstream Infrastructure Report

Comments