January 2021, Vol. 248, No. 1

Global News

Global News

Missile Attack on Saudi Distribution Plant Has Little Impact

Iran-aligned Houthi forces fired a missile that struck Aramco’s North Jeddah Bulk Plant, authorities said, but Saudi Aramco said its domestic fuel supplies were not affected.

Abdullah al-Ghamdi, manager of the North Jeddah plant, said the missile struck a 500,000-barrel storage tank, causing major damage to its roof.

“It was a big fire, a big explosion, but was dealt with swiftly,” Ghamdi said.

The fire was extinguished in around 40 minutes with no casualties and resulted in the shutdown of only one of 13 storage tanks used for diesel oil, gasoline and jet fuel.

Aramco’s oil production and export facilities are mostly in Saudi Arabia’s Eastern Province, more than 1,000 km (620 miles) from Jeddah.

Islamic State Claims Responsibility for Sinai Pipeline Blast

An explosion at a natural gas pipeline in Egypt’s restive northern Sinai Peninsula caused a fire but little other damage, and there were no casualties, a senior military official said.

Gen. Mohamed Abdel Fadil Shousha, in charge of the northern part of the peninsula, said all the pipeline valves were promptly sealed off to control the fire that erupted after the blast.

The Islamic State (IS) group posted a statement on its website claiming responsibility for the explosion. It said IS militants detonated several explosive devices to damage a pipeline that carries natural gas from Egypt to Israel. The group offered no proof for its claim.

Egypt has for years been battling an insurgency in northern Sinai that’s now led by the IS affiliate. It has carried out a number of large-scale attacks in recent years, mainly targeting members of the security forces and Egypt’s Christian minority.

Oil Companies Tighten Nigeria Security as Protests, Job Losses Stoke Tension

Oil companies operating in Nigeria have asked security services to tighten surveillance as violent anti-police brutality protests and the expected firing of hundreds of workers worsen desperation in the region.

Already unemployment is above 40% in Nigeria’s energy regions, and observers say further job losses could aggravate problems of pipeline tapping, illegal oil refining and pirate attacks.

Three sources close to the companies, speaking on condition of anonymity, told Reuters that the majors have asked for tougher surveillance, including a closer watch on pipelines. Non-government organizations also said there is a risk of increased crime.

“It’s going to increase the desperation in the region, which leads to criminality,” said Ken Henshaw, executive director at Port Harcourt-based NGO We The People.

Oil major Chevron plans to cut 25% of its Nigeria workforce, which union leaders said includes 1,000 jobs.

India Targets Fourfold Increase in Natural Gas Share of Energy Mix

India plans to nearly quadruple the share of natural gas in its energy-consumption mix and double its oil refining capacity in the next five years, Prime Minister Narendra Modi said, indicating a more aggressive timeline than officials have previously described.

A fourfold increase in natural gas consumption would give it a 24% share of all energy consumed in India. It currently accounts for about 6% of the country’s energy mix.

India would achieve its targets of increasing renewable energy capacity to 175 gigawatts by 2022 and 450 gigawatts by 2030 ahead of schedule, Modi added. The country had renewable energy capacity of about 75 gigawatts at the end of 2018.

Trump Pushes New Environmental Rollbacks on Way Out the Door

In its final weeks, the Trump administration worked to push through dozens of environmental rollbacks that may benefit industry, deepening the challenges for an incoming president who made the environment a core piece of his campaign.

Environmental Protection Agency (EPA) spokesman James Hewitt said, “EPA continues to advance this administration’s commitment to meaningful environmental progress while moving forward with our regulatory reform agenda.”

Pushing to get new rules on the books before the end of a president’s term is not unusual. Agency heads for former President Barack Obama pushed through changes that toughened pollution rules on the oil and gas industry after Trump’s 2016 victory.

Some decisions, if they go into effect, will be easy for President-elect Joe Biden to simply reverse. He already has pledged to return the United States to the Paris climate accord as a first step in his own $2 trillion climate plan. But he faces years of work in court and within agencies to reverse major changes to environmental regulations.

Enbridge Sues Michigan Over Oil Pipeline Shutdown Order

Enbridge filed a legal challenge to Michigan Gov. Gretchen Whitmer’s recent demand that the company shut down its oil pipeline that crosses the waterway connecting Lake Huron and Lake Michigan.

The Canadian company accused the state of overstepping its bounds, arguing that Enbridge’s Line 5 was under the sole regulatory jurisdiction of the U.S. Pipeline and Hazardous Materials Safety Administration.

“This is the latest attempt by the state of Michigan to interfere with the operation of this critical infrastructure by assuming authority it does not possess,” Enbridge said.

Whitmer signed an order on Nov. 13 to halt the flow of oil within 180 days, contending that Enbridge had violated an easement granted 67 years earlier, and Attorney General Dana Nessel sued in state court to enforce the order.

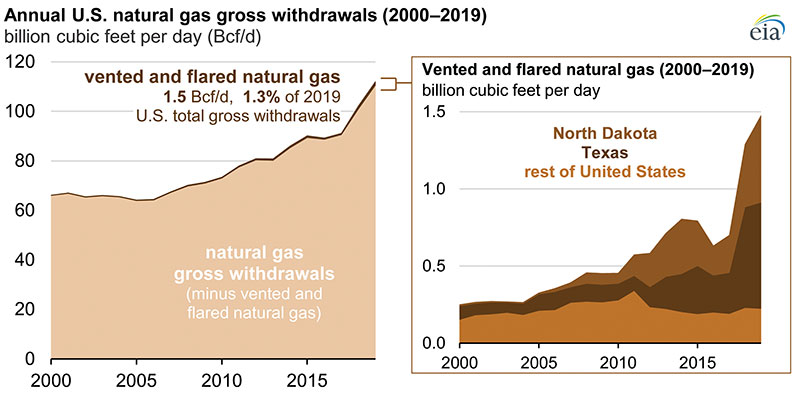

U.S. Natural Gas Venting, Flaring Reach Record High

The volume of U.S. natural gas that was vented and flared in 2019 reached a record-high annual average of 1.48 Bcf/d (41.9 MMcm/d) in 2019, as crude oil production outpaced the construction of pipelines to transport associated natural gas, government statistics show.

The percentage of natural gas that was vented and flared during the year increased to 1.3% of gross withdrawals, the U.S. Energy Information Administration (EIA) said in its 2020 Natural Gas Annual report, published in December. North Dakota and Texas combined accounted for 85%, or 1.3 Bcf/d (37 MMcm/d), of those volumes, it said.

Texas accounted for 47% and North Dakota accounted 38% of the total U.S. vented and flared natural gas. State agencies in Texas and North Dakota are working with oil producers to limit the need for flaring without shutting down or affecting crude oil production from new wells. Venting is banned in North Dakota and restricted in Texas.

The Bakken play accounts for 93% of all crude oil and 98% of all natural gas produced in North Dakota. Natural gas production from the Bakken play grew from 0.2 Bcf/d (5.7 MMcm/d) in 2010 to nearly 2.9 Bcf/d (82 MMcm/d) in 2019. During this time, natural gas processing plant capacity and pipeline capacity have not kept pace with the growth in natural gas production.

In 2019, flared natural gas in North Dakota totaled 0.6 Bcf/d (17 MMcm/d), up from 0.4 Bcf/d (11 MMcm/d) in 2018. The percentage of total natural gas gross withdrawals that was flared in North Dakota increased from 17% to 19% from 2018 to 2019, the highest percentage of any state.

In Texas, growing crude oil production from the Permian Basin and Eagle Ford plays has contributed to a rapid increase in natural gas flaring in recent years. In 2019, vented and flared natural gas in Texas increased to 0.7 Bcf/d (20 MMcm/d), about 2.4% of total 2019 natural gas gross withdrawals production in the state. The 2019 percentage of vented and flared natural gas is down from the 2018 high of 2.6%.

ExxonMobil to Cut up to 300 Jobs in Canada

ExxonMobil plans to eliminate up to 300 jobs in Canada by the end of 2021 as part of its ongoing efforts to lower costs. It said the global pandemic has made the cutbacks more urgent.

The job cuts will occur across all of its Canadian affiliates, including Imperial Oil Limited, ExxonMobil Canada Ltd. and ExxonMobil Business Centre Canada ULC, it said. There are currently about 7,300 employees working at those affiliates, a spokesperson said.

“Canada remains an important market for ExxonMobil,” the company said in its brief announcement. “However, further actions are needed at this time to improve costs and ensure the corporation and its affiliates manage through these unprecedented market conditions.

The workforce reductions “result from insight gained through reorganizations and work-process changes made over the past several years,” ExxonMobil said, adding, “The impact of COVID-19 on the demand for ExxonMobil’s products has increased the urgency of the efficiency work.”

ExxonMobil already announced plans in late October to cut its global workforce by about 15%, or roughly 14,000 positions. It had about 88,300 workers, including 13,300 contractors, at the end of last year.

It estimated about 1,900 employees would lose their jobs in the United States, mostly from its Houston-area campus – the headquarters of its North American oil and gas business.

Line 5 moves about 23 million gallons of oil and natural gas liquids daily. The underwater section beneath the straits is divided into two pipes. Enbridge says they are in sound condition and have never leaked but are aging and need to be replaced. It plans to construct a new pipeline section through a tunnel beneath the lake bottom.

Belarus Plans to Raise Pipeline Tariff on Russian Oil by 25%

Belarus has proposed to increase a tariff it charges Russia for oil transit to Europe by a quarter, raising the stakes in oil supply talks complicated by political upheaval in Minsk, Reuters reported.

Belarus state energy company Belneftekhim notified Russian pipeline operator Transneft that it wanted to increase the transit tariff via the Druzhba pipeline for Russian suppliers by almost 25% from Jan. 1, 2021, much higher than envisaged by Moscow, three industry sources told Reuters.

Oil talks have been bogged down by other unresolved issues between the countries, including natural gas sales as well as compensation for Russian-contaminated oil supplies.

Belneftekhim, Transneft and the Russian energy ministry did not respond to requests for comment.

Eni Strikes Deals to Reopen Egypt’s Damietta LNG Plant

Eni said it has reached new agreements that could pave the way for its LNG plant in the port city of Damietta to restart operations during the first quarter of the new year.

The new deal, which still needs the green light from European Union authorities as well as other conditions to be met, will allow Eni to increase its LNG portfolio and strengthen its gas foothold in the Eastern Mediterranean.

Naturgy said in a separate statement that it will receive a series of cash payments totaling around $600 million under the deal, which when completed will result in its departure from Egypt and the end of its joint venture with Eni.

The Damietta plant was 80% owned by Union Fenosa Gas, a joint venture between Eni and Naturgy, with the rest split evenly between the Egyptian Natural Gas Holding Company (EGAS) and Egyptian General Petroleum Corporation (EGPC). Under the new agreement, the plant will be 50% owned by Eni, 40% by EGAS and 10% by EGPC.

Eni, one of the biggest foreign oil and gas producers in Africa, discovered Egypt’s biggest-ever gas field Zohr in 2015.

Comments